Blackcomb Consultants is now part of Accenture | Insurance Blog

Blackcomb Consultants is now part of Accenture

I am excited to welcome Blackcomb Consultants, a leading independent Guidewire partner in North America, into the Accenture family.

Why Blackcomb Consultants?

Amid market disruption and heightened consumer expectations, insurers are turning to platforms such as Guidewire to drive strategic digital and business transformation. Accenture and Blackcomb Consultants share a vision focused on delivering innovation to P&C carriers of all sizes, helping them create a sustained competitive advantage

I have previously spoken about how Guidewire is helping insurers transform. Guidewire’s end-to-end technology platform combines digital, core analytics and artificial intelligence capabilities across the underwriting, billing, claims and customer relationship management functions, helping property and casualty insurers reimagine their operations in the cloud.

We thoroughly examined the marketplace and Blackcomb’s reputation among its clients was unmatched. Joining forces really brings our total reinvention story to life by adding a company to our repertoire with deep expertise in Guidewire, the market-leading platform in the industry. As a Guidewire ‘Advantage’ partner, Blackcomb Consultants’ offerings include policy administration system implementations and upgrades, production support, cloud-hosted services, performance improvement and organizational-change services. They also have specialized capabilities in delivering Guidewire applications and services on Amazon Web Services and Microsoft Azure.

What this means for Accenture and Guidewire

With Blackcomb’s deep technical expertise and excellent reputation, this partnership enhances Accenture’s ability to deliver Guidewire solutions to insurers globally to help them become “cloud-first” businesses. Its 158 employees, including North American on-shore personnel, will join our Industry & Function Platforms Group, where they will be focused on Guidewire project delivery. This investment by Accenture will allow our clients to have the resources necessary to implement Guidewire solutions to meet their needs, and the combined companies bring scale to allow carriers to realize their total enterprise reinvention journey.

Read the press release: Accenture Acquires Blackcomb Consultants to Help Insurance Carriers Accelerate Digital Transformation in the Cloud

To learn more about what this means for your business, please contact me.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

Disclaimer: This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.

What does the metaverse mean for insurers? | Insurance Blog

The metaverse is a concept making headlines across the globe, with its application being imagined across all industries. However, until recently, the practical manifestation and future impact of the metaverse was unknown. The newly-released Insurance Tech Vision for 2022 not only defines the metaverse, but contains valuable, timely insights for insurers on how the metaverse is ushering in the next wave of digital change.

Accenture defines the “Metaverse Continuum” as a spectrum of digitally enhanced worlds, realities and business models poised to revolutionize life and enterprise in the next decade. This applies across all aspects of business, from consumer to worker and across the enterprise; from reality to virtual and back. The metaverse continuum is being built on a wide range of mature and emerging technologies. These technologies include artificial intelligence (AI), augmented and virtual reality (AR/VR), blockchain, digital twins, edge technologies, cloud, digital currencies, non-fungible tokens (NFTs), social platforms, ecommerce, and digital marketplaces.

What does this mean for the insurance industry? Whether for an enterprise or consumers, the metaverse has different platforms, partners, and technologies at its core. As the next evolution of the Internet, the metaverse will be a continuum of technologies, working together, to create immersive content and experiences. The metaverse continuum will elevate expectations for how insurers interact with customers, what products and experiences they design and distribute, and how they operate their organizations. It will also require a wider digital and creative skill set to bring this digital reality to life.

The Insurance Technology Vision explores how these innovations are becoming the building blocks of the insurance industry’s future. Insurers who understand these trends and what they mean for customers will be well poised to gain a competitive advantage.

The implications of the following four Tech Vision trends for insurers are covered in the report:

- WebMe – Putting the me in metaverse.

Given the seamless, decentralized nature of Web3, formulating ecosystem partnerships and their ensuing cloud transformations will be essential for insurers. - Programmable world – Our planet, personalised.

Technology advances like 5G and devices like AR glasses are changing the way insurers access and relate to the physical world, offering new levels of control, automation, and personalization. - The Unreal – Making synthetic authentic.

As bad actors take advantage of new attack surfaces in the metaverse, insurers will play an essential role in mitigating the risk. - Computing the impossible – New Machines, new possibilities.

The ability of insurers to quickly process enormous datasets from multiple sources will transform risk modeling and decision effectiveness.

As you will discover, there is a compelling case for the Metaverse within insurance, from shifting revenues and distribution models to new workforce training experiences, with some leading insurers already taking advantage of the trend. In this series, I will be looking deeper into some of this year’s Tech Vision trends, sharing my own current examples of insurers who are pioneering the application of the metaverse in our industry.

Insurance Technology Vision 2022: We explore how today’s metaverse innovations are becoming the building blocks of the insurance industry’s future. Register to download the report.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

Disclaimer: This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.

Explore the insurance trends for 2022 and beyond | Insurance Blog

What role will insurance play in the future? How can insurers work with customers and parallel industries to create tangible value and make a positive impact on our planet? These are some of the questions answered in the Qorus-Accenture Innovation in Insurance Trends Report, which is out now. I believe that this year’s trends show how insurers and their partners are reinventing themselves to support the evolving needs of their customers, intermediaries and employees.

The report gathers rich and diverse data from the hundreds of submissions received by the Qorus-Accenture Innovation in Insurance Awards, an annual awards program that celebrates the wide range of innovations shaping the future of the industry, from smart, collaborative ecosystems to compelling uses of AI and more. From vaccination incentive programs to remote claims assessment solutions and AI-enabled health checks, this year’s awards showed clear trends in insurance innovation and illustrated how innovation continues to mature post-pandemic. There is no doubt that the principle of providing relevant insurance products and services to customers has evolved into something much wider, more integrative and more human. It is an exciting, positive time to be in the insurance industry.

The recently-released 2022 report tells a compelling story of innovation in the industry, supported by a wide range of practical examples. Download the report to not only see how innovation in insurance is being manifested in different markets, but to hear insurers tell their innovation story and motivation in their own words.

Qorus-Accenture Innovation in Insurance Trends 2022: Our report highlights the key insurance innovation trends that are shaping the industry.

These are the key trends that are discussed in depth in the report.

- Trend 1: Authentic omnichannel

Engaging customer experience, anywhere and everywhere

- Trend 2: Embedded ecosystems

Complementary ecosystems for deeper value

- Trend 3: Health and wellbeing convergence

Making customers’ lives better and proactively reducing risk

- Trend 4: Sustainable insurance

Positively contributing to communities and the planet

- Trend 5: AI and Tech differentiation

Intelligent technology that sets insurers apart

- Trend 6: Workforce rearchitected

The people powering the reimagined insurance landscape

It is exciting to see how these trends are influencing behaviors and contributing to safer, greener and more inclusive industry practices, enabling insurers’ positive impact on society.

The Qorus-Accenture Innovation in Insurance Awards constitute a meaningful opportunity to share your company’s excellence in insurance innovation. Enter the 2023 awards.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

Disclaimer: This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.

Insurance News: The next horizon of expansion | Insurance Blog

As insurers look to the next horizon of expansion with an inclusive and diverse approach, there are a number of opportunities influencing scale potential including acquisitions, capital investments, the metaverse and the emergence of insurtech 2.0.

In this month’s Insurance News Analysis, Joanne Laffan and I discuss how a pre-scale insurer like Lemonade is planning to leapfrog its competitors through its recent acquisition of Metromile, a pay-per-mile car insurance company.

With the advent of Ethereum Merge in an effort to combat the carbon-intense energy consumption from blockchain in cryptocurrency, we discuss what it means for insurers’ capital investments as they’re trying to stay on top of both new technology and net zero targets.

We also discuss some of the early ways we expect to see the metaverse impact insurers’ operations and their customer and employee experiences. Plus we focus on the implications of so-called ‘insurtech 2.0’ which emerged as a hot topic of conversation at ITC 2022 in Las Vegas.

Finally, after a new U.S. House Committee report found there was little change in racial, ethnic and gender representation among employees at the largest U.S. insurers between 2017 and 2021, we discuss practices that insurers can implement to ensure inclusion and diversity is promoted.

The case for composable architecture in insurance | Insurance Blog

Within the insurance industry, we understand that in order to remain relevant and retain market share we need to be agile, innovative and adopt new technologies. From a technical point of view, this means that insurers need to be able to adapt their enterprise architecture quickly and sustainably in order to reinvent themselves and grow. However, in an industry rife with legacy architecture, systems modernization is a pressing problem. How can insurers design future systems that both uphold the legacy they have created and integrate into the modern world?

Accenture is working alongside its insurance clients to address this challenge. The result is a new frontier in how technological infrastructure is built.

Insurance architecture design is changing

We need to change how insurance architecture is designed for greater agility and growth. This is not confined to our industry alone. Across all industries, there is a seismic shift from inflexible, monolithic architecture to modular apps that can adapt to business change by assembling, reassembling, and extending. This assists organizations in keeping pace with changing customer demands, supply chain disruptions, economic uncertainty, and the rapid pace of technological advancement.

Insurance is an industry rich with data yet often encumbered by legacy technology. New, adaptable solutions will set leading insurers apart. According to Gartner, by 2023 organizations that have adopted an intelligent composable approach will outpace competition by 80% in the speed of new feature implementation.

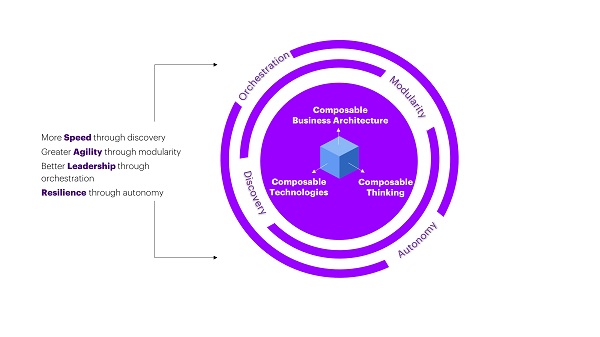

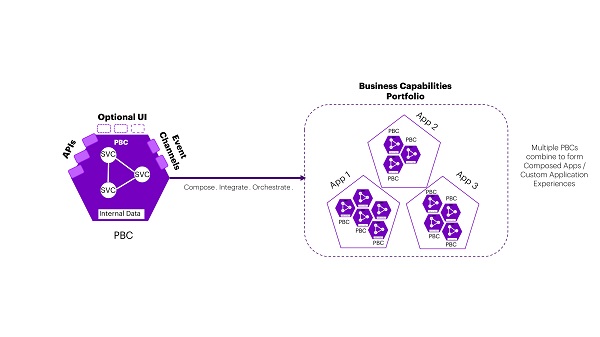

The composable enterprise in insurance – what’s new

A composable enterprise can be defined as an organization that delivers business outcomes effectively and adapts to the pace of business change. The digital architecture that enables the composable enterprise is built on a strong Application Program Interface (API)-centric mindset, with business functions that are encapsulated in interchangeable components. In composable architecture, APIs help to enhance pliability and ecosystem oversight. This helps the organizations to democratize the business process and become a highly scalable digital business. For insurers, this approach holds numerous possibilities to simplify and scale their digital operations. Packaged business Capabilities (PBCs) – encapsulated software components that represent a well-defined business capability – can be created to be easily recognizable to business users. While the concept of composable architecture has been around for a few years, we are now harnessing the power of PBCs to create truly replicable and scalable infrastructure solutions.

How insurers can benefit

By leveraging the possibilities of a composable enterprise and PBCs, insurers can scale with speed and agility. to create a strong foundation for a composable enterprise:

- Build Modular Business Capabilities: If insurers want to build a scalable composable architecture, they need to have a set of autonomous business capabilities that can be plugged together to execute a business process uniquely that brings a competitive advantage. These modular business capabilities should have the ability to be managed independently and improved while participating in a larger business model.

- Create Modular Technology Capabilities: To support the modular business capabilities, insurers need to build modular technology capabilities that can be easily integrated to enable smarter business models. These need to be autonomous, managed and modular in order to be combined via a standard interface to support the required business need.

In summary, taking a composable approach to technological architecture in insurance has game-changing potential. It allows insurers to future-proof strategy through design, focus on proactive creation and see increased speed in feature implementation. In our next blog post in this series, I will share practical examples of composable architecture in an insurance claims context.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.