3 ways insurance underwriters can gain insights from generative AI | Insurance Blog

Generative AI (GenAI) has the potential to transform the insurance industry by providing underwriters with valuable insights in the areas of 1) risk controls, 2) building & location details and 3) insured operations. This technology can help underwriters identify more value in the submission process and make better quality, more profitable underwriting decisions. Increased rating accuracy from CAT modeling means better, more accurate pricing and reduced premium leakage. In this post, we will explore the opportunity areas, GenAI capability, and potential impact of using GenAI in the insurance industry.

1) Risk control insights zone in on material data

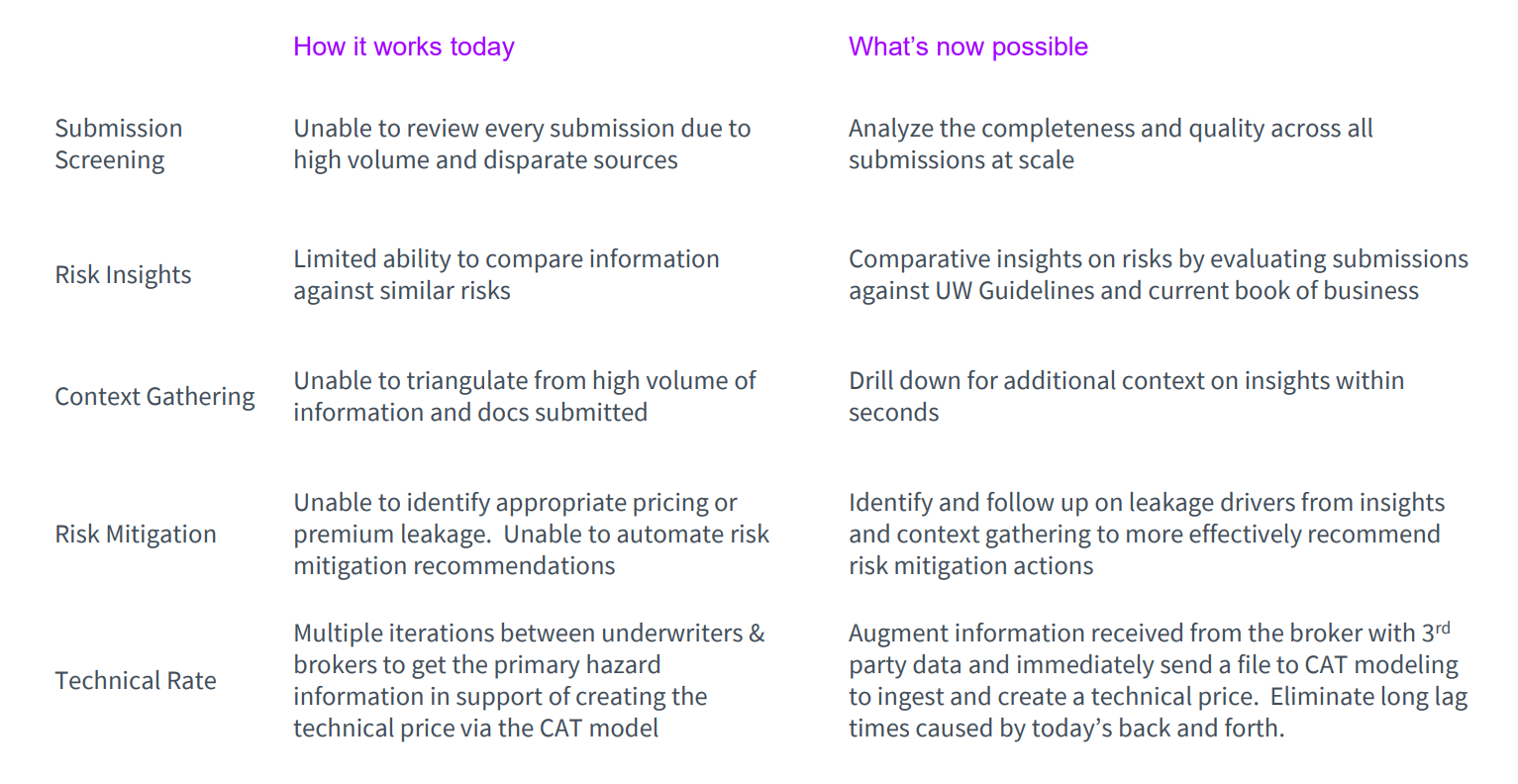

Generative AI allows risk control analysis insights to be highlighted to show loss prevention measures in place as well as the effectiveness of those controls for reducing loss potential. These are critical to informed underwriting decisions and can address areas that are consistently missed or pain points for underwriters in data gathering. Currently when it comes to submission screening, underwriters are unable to review every submission due to high volume and disparate sources. Generative AI allows them to analyze the completeness and quality across all submissions at scale. This means that they move from a limited ability to compare information against similar risks to a scenario where they have comparative insights on risks by evaluating submissions against UW Guidelines and current book of business.

What generative AI can do:

- Generate a comprehensive narrative of the overall risk and its alignment to carriers’ appetite and book

- Flagging, sourcing and identifying missing material data required

- Managing the lineage for the data that has been updated

- Enriching from auxiliary sources TPAs/external data (e.g., publicly listed products/services for insured’s operations)

- Validating submission data against those additional sources (e.g., geospatial data for validation of vegetation management/proximity to building & roof construction materials)

Synthesizing a submission package with third party data in this way allows it to be presented in a meaningful, easy-to-consume way that ultimately aids decision-making. These can all enable faster, improved pricing and risk mitigation recommendations. Augmenting the information received from the broker with third party data also eliminates the long lag times caused by today’s back and forth between underwriters and brokers. This can be happening immediately to every submission concurrently, prioritizing within seconds across the entire portfolio. What an underwriter might do over the course of a week could be done instantaneously and consistently while making informed, structured recommendations. The underwriter will immediately know control gaps based on submission details and where significant deficiencies / gaps may exist that could impact loss potential and technical pricing. Of course, these must then be considered in concert with each insured’s individual risk-taking appetite. These improvements ultimately create the ability to write more risks without excessive premiums; to say yes when you might otherwise have said no.

2) Building & Location details insights aid in risk exposure accuracy

Let’s take the example of a restaurant chain with multiple properties that our insurance carrier is underwriting to illustrate building detail insights. This restaurant chain is in a CAT-prone region such as Tampa, Florida. How could these insights be used to supplement the submission to ensure the underwriter had the full picture to accurately predict the risk exposure associated with this location? The high-risk hazards for Tampa, according to the FEMA’s National Risk Index, are hurricanes, lightning, and tornadoes. In this instance, the insurance carrier had applied a medium risk level to the restaurant due to:

- a past safety inspection failure

- lack of hurricane protection units

- a potential link between a past maintenance failure and a loss event

which all increased the risk.

On the other hand, in preparation for these hazards, the restaurant had implemented several mitigation measures:

- mandatory hurricane training for every employee

- metal storm shutters on every window

- secured outdoor items such as furniture, signage, and other loose items that could become projectiles in high winds

These were all added to the submission indicating that they had the necessary response measures in place to decrease the risk.

Whereas building detail insights expose what is truly being insured, location detail insights show the context in which the building operates. Risk control analysis from building appraisals and safety inspection reports uncover insights showing which locations are the top loss driving locations, whether past losses were a result of covered peril or control deficiency, and adequacy of the control systems in place. In the case of the restaurant chain for example, it did not have its own hurricane protection units but according to the detailed geo-location data, the building is located approximately 3 miles away from the closest fire station. What this really means is that in terms of context gathering, underwriters move from being unable to triangulate from high volume of information and documents submitted to being able to drill down for additional context on insights within seconds. This in turn allows underwriters to identify and follow up on leakage drivers from insights and context gathering to recommend risk mitigation actions more effectively.

3) Operations insights help provide recommendations for additional risk controls

Insured operations details synthesize information from the broker submission, financial statements and information on which aspects are not included in Acord forms / applications by the broker. The hazard grades of each location associated with the insured’s operations and the predominant and secondary SIC codes would also be provided. From this, immediate visibility into loss history and top loss driving locations compared with total exposure will be enabled.

If we take the example of our restaurant chain again, it could be attributed a ‘high’ risk value rather than the aforementioned ‘medium’ due to the fact that the location has potential risks from e.g. catering delivery operations. By analyzing the operation exposure, this is how we identify that high risk in catering :

The maximum occupancy is high at 1000 persons, and it is located in a shopping complex. The number of claims over the last 10 years and the average claim amount could also indicate a higher risk for accidents, property damage, and liability issues. Although some risk controls may have been implemented such as OSHA compliant training, security guards, hurricane and fire drill response trainings every 6 months, there may be further controls needed such as specific risk controls for catering operations and fire safety measures for the outdoor open fire pizza furnace.

This supplementary information is invaluable in calculating the real risk exposure and attributing the correct risk level to the customer’s situation.

Benefits to generative AI beyond more profitable underwriting decisions

As well as aiding in more profitable underwriting decisions, these insights supply additional value as they teach new underwriters (in significantly reduced time) to understand the data / guidelines and risk insights. They improve analytics / rating accuracy by pulling all complete, accurate submission data into CAT Models for each risk and they reduce significant churn between actuary /pricing / underwriting on risk information.

Please see below a recap summary of the potential impact of Gen AI in underwriting:

In our recent AI for everyone perspective, we talk about how generative AI will transform work and reinvent business. These are just 3 ways that insurance underwriters can gain insights from generative AI. Watch this space to see how generative AI will transform the insurance industry as a whole in the coming decade.

If you’d like to discuss in more detail, please reach out to me here.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. Copyright© 2024 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

Insurance News: International Women’s Day Special Edition | Insurance Blog

In celebration of International Women’s Day, we are delighted to be part of a panel of extraordinary women leaders for this special edition of Insurance News Analysis. We discuss the strides being made toward gender equality and the work that remains.

So, what is being done to recruit, retain and promote women in the insurance industry? The research shows that attracting women is not a problem, but there is a struggle in growing that talent into leadership roles . Our guest Gunjali Rana, Assistant Vice President of Diversity, Equity & Inclusion at CNA, one of the Insurance Business 5-Star DE&I winners, adds that while the disparity in pay between men and women is certainly an issue, there are other gaps to consider.

Insurance companies are now establishing programs dedicated to increasing representation of women and diverse groups in the industry. Trina Bowser, the Accenture member of the Black Insurance Industry Collective (BIIC) Leadership Council, discusses how the BIIC partners with companies to create programs that promote mentorship and sponsorship.

According to the Accenture Future of Work study, a staggering 70% of the global workforce carries caretaking responsibilities for children, parents and other loved ones. Our panel shares tactics they have leveraged that may help women in the workforce remain in their roles and grow their careers.

We also touch on the responsibility of the insurance industry when it comes to inclusive insurance, which our colleague Heather Sullivan talked about recently on her blog.

Accenture’s IWD theme this year is “Be Without Limits.” We wrap the session by sharing inspirational women our panelists believe have lived without limits.

Happy International Women’s Day!

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

Disclaimer: This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.

3 life insurance underwriting predictions for the year ahead | Insurance Blog

Life insurance stands on the cusp of a new chapter in reinvention. Until now, insurers have been gradually moving forward with wide-scale digital transformation. But with the impacts of AI, including generative AI, change is coming fast. We’re in a vibrant new year, and life insurers are starting to accelerate and implement their reinvention strategies. This is the time to be bold.

These underwriting predictions offer insights into how carriers can take action to truly become digital this year.

Generative AI brings next-level customer centricity

Generative AI-empowered customer centricity will close the gap even further between carriers and customers for more personalized product offerings and services. This trend will continue to reach new levels in the year ahead as new technologies enable deeper connections between customers, advisors and carriers. Recent Accenture research found that today’s customers feel the need for protection in areas beyond what traditional insurance offers. For example, the next generation of insurance customers say they feel less protected for mental health. To address these concerns and more, guidance from an advisor is key. However, insurers have been unable to provide that level of customer experience—until now.

Generative AI extends the care and knowledge of hyper-personalized solutions to more people. Digital agents, diverse chat functionalities, ask-me-anything capabilities and the evolution of enterprise-level generative AI solutions are swiftly bridging existing gaps within the customer-advisor-carrier framework in the industry—and this is just in the beginning stages.

In last year’s predictions, I highlighted how new levels of AI and automation capabilities would enhance real-time underwriting decisions and enable a faster digital buying experience. We believe this trend will also continue this year as more and more life insurers begin their implementation strategies.

It’s worth monitoring the development of generative AI underwriting tools in 2023 that work to enhance the efficiency and accuracy of underwriting and risk management as well as streamline processes and generate valuable insights. Often referred to as Underwriter Co-pilot at Accenture, this technology will play an even stronger role in 2024 as it continues to be fine-tuned with advances in LLMs.

I want to be clear that new technologies will not replace advisors. These technologies are necessary as insurers continue to face skilled labor shortages across the insurance value chain. The solutions that are more personal and customized work to address a different type of skills shortage. With the retirement crisis in insurance still on the horizon, Human + Machine collaboration will become even more crucial as we look for new ways to support employees across the core business functions of both underwriting and claims.

To share a concrete and recent industry implementation, Accenture helped a large A&H insurer to automate its claims process by using advanced voice AI, AI-powered human assist capabilities, a digital virtual assistant and proactive, multi-day journeys. The journeys involved two-way messaging tied to an event that helped complete a customer’s request in the same channel for a smoother experience while the AI-powered assistant worked to provide real-time AI-based guidance to agents during customer conversations.

Digitalization will pick up speed to start the reinvention journey

Life insurers may tout digital underwriting processes and aspirations, but many are still stuck in analog operations. Carriers have been paper-based companies with paper-based processes, and this continues to be the foundation of business as today’s paper takes the form of PDFs, Excels and Adobe. But in 2024, true digitalization and the transition to real-time data will be more achievable than ever if carriers have the imagination and leadership to start the reinvention journey.

The reinvention will be to truly make life insurance digital end-to-end—transitioning everything in your business to real-time data. From improving your claims core and engagement system to enhancing the underwriter’s workflow, once information is data, there are so many ways to rewrite processes. And the benefits are there, including expense savings, uptake and many more. While I do not believe this will be the year for completing full reinvention, it is the year to start your journey by focusing on pieces of your business to reinvent.

I would recommend taking inspiration from one of today’s industry-transforming leaders. Ping An launched a pilot digital solution to enhance agent planning, increase sales performance and improve its life insurance business. This pilot resulted in a decrease of development time by 30% and a service re-use rate of 25%.

The time is now to move from experimentation to implementation

To start any journey requires action. Several life insurers will take important steps in their digital journeys this year by going beyond proof of concept to implement the transformative tools and mature technologies currently available.

Entering the implementation phase will drive business transformation, impacting everything from the underwriting experience and the claims experience to the customer experience and beyond. As a growing technology area in insurance, intelligent ingestion (the ability to digitally ingest data) offers incredible advantages as a starting point for this phase.

As a final thought for this blog post, another noteworthy development to keep an eye on is the emergence of comprehensive beneficiary care services as a distinguishing value proposition for the selling of new products—a topic I’ll explore more in my next blog. Stay tuned.

Let’s talk about implementing initiatives for your reinvention journey.

Additionally, check out Accenture’s new network of generative AI studios.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.