Why smart insurers are modernizing their mainframe now | Insurance Blog

In a market that calls on insurers to be agile and digitize at scale, an insurer’s mainframe can either catalyze or inhibit progress. While the mainframe was once a valuable core technological function, many legacy mainframes lack the agility to meet the demands of customer expectations and rapid digital progress.

The call for mainframe modernization

Insurers want to reach a digital end-state and embed the enabling functions they need to perform in the cloud using a route that is faster, better, and cheaper. Modernizing the mainframe is the last mile towards enabling business capabilities, reimagining the business and driving a cloud operating model.

If we look at the market forces shaping the wider industry, insurers are being called upon to be more agile so as to keep pace with rapidly changing demands. This is due to a range of factors, from higher inflationary environment expenses for insurance operations and increasing claims, to the impact of the global pandemic and predicted recession. With a high-interest rate environment and future predicted volatility, costs need to come down, and one of the costs that is increasing year over year is maintenance of the mainframe.

Zooming in on sectors within insurance, this need for agility is manifested in different ways. Property and Casualty (P&C) insurers not only need to be more agile, but need to focus on marketing points of differentiation while commoditizing non-differentiators. The Life & Annuity (L&A) and Retirement industry will benefit from unlocking distribution, a feat which is currently not possible because a lot of that logic is embedded in the mainframe. Therefore, the focus is on modernizing the mainframe to enable digital channels. Group and Retirement insurers are undergoing a compressed transformation – meaning that the sector requires reimagined operations from the ground up in order to improve customer relationships and gain a competitive advantage – with Group hurting on margins, and Retirement hurting on margins and scale. Finally, Group and Health insurers are being challenged to drive down the cost basis, and drive growth, for example, by adding a wellness layer to their offering.

From a cost perspective, the case for mainframe modernization is clear. The demand placed on the insurance infrastructure is increasing, with business capability needs driving up Million-Instructions-Per-Second (MIPS) usage and cost. A legacy mainframe also has an impact on talent, as dedicated staff will be required to provide maintenance and upkeep – a diminishing skillset as more and more senior employees retire from the workforce. Down the line, this manifests as a considerable business risk.

Modernizing the mainframe is not just about overall agility, but securing a foundation for important technological transformation. In a recent report on Transforming Claims and Underwriting with AI, Accenture illustrates with widespread industry research that AI has emerged as the transformative technology and critical differentiator in the insurance industry when applied in tandem with humans. However, AI transformation is not possible if an insurer has not dismantled and updated mainframe platforms first.

Mainframe modernization outcomes

Modernizing the mainframe offers some compelling benefits. By running in a less expensive environment, operating costs are drastically lowered, and the use of a more modern platform dramatically reduces platform resource costs. Together, this can result in a 40 percent reduction in operating expenses. While this savings is significant, it is not the only benefit. Most importantly, mainframe modernization – through agility, flexibility and access to critical mainframe data – has a powerful impact on business value. As a recent Accenture blog, Mainframes: The last frontier of cloud migration emphasizes, customers are able to leverage their mainframe data, which can contain decades of business transactions, and use that data to feed analytics or machine learning initiatives that can deliver competitive advantage. The blog post also illustrates the important role the modernization of the mainframe plays in closing the skills gap – it can counter the problem many companies are facing as their mainframe experts reach retirement age and can also attract new talent interested in modernizing core business workloads.

Modernization also offers the ability to deploy new features, products and capabilities much quicker and in conjunction with interoperable applications, promises up to five times deployment speeds. New business capabilities such as the ability to incorporate AI and ML, real-time decision-making and data processing efficiency are also unlocked. These benefits can be brought about by conservative adjustments, or a complete system transformation. It all depends on the strategic and growth priorities of the insurance business.

New platforms and migration technologies allow for compressed transformations

Mainframe modernization is not a one-size-fits-all proposition. It is driven by the unique market needs of the insurer and the strategic intent of the business. There is a wide spectrum of choices available to modernize at a pace that is comfortable and necessary for the insurer. Today’s mainframe migration technology supports this, allowing for automated, fast, and low-cost migration to the cloud. This technology includes SaaS solutions, Cloud maturity and advances in migration technologies.

In terms of approaches, insurers can roll out the following interventions, which all vary in scale and intensity:

- Re-platform: Migrating an application without changing the programming language to another platform / Operating System

- Re-factor: Harnessing Accenture’s language migration toolkit to transform from legacy to modern programming language code, using (semi) automated tooling to mitigate risk relating to legacy skills, increase agility and reduce costs

- Replace: Identifying a managed service/application that can provide required functionality, including extracting and migrating data to a new system to reduce complexity and costs

- Reimagine: Reimagining the business entirely with rewritten and rationalized applications

How insurance companies can begin their mainframe modernization journey

There are nuances to how mainframe modernization is applied within insurance. These solutions differ in intensity from business benefits to the technology used. The application depends on whether the insurer specializes in life and annuities, group and health, retirement, personal lines/small commercial and large commercial. However, there are three key steps that determine the direction of every mainframe modernization journey:

- Defining business priorities

-

- a. What are the highest priorities for the business?

-

- b. How do those align to the key problems caused by running on the mainframe?

-

- Identifying budget constraints

-

- a. What is the budget available today?

-

- b. What is the duration available to realize ROI?

-

- Determining capacity for transformation

-

- a. What is the IT team’s capacity for transformation?

-

- b. Are there resources available?

-

- c. Is there a lot of other change happening?

-

Following this process results in a unique mainframe modernization plan.

Accenture’s insurance mainframe modernization methodology will help you develop a journey aligned with your goals. Contact us to get started.

Fuel the future of insurance: Technology modernization, such as AI and cloud-fueled data analytics, helps insurers deliver profitable growth both through growing revenues and cutting costs.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

Disclaimer: This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.

Insurance News: 2022 in review | Insurance Blog

As we near the end of 2022, the insurance industry is responding to disruption across all lines of business. From customers concerned about crypto losses to employers still assessing the risks of COVID-19, insurers are finding ways to offer protection.

In this final Insurance News Analysis of the year, Abbey Compton and I are happy to welcome Cindy De Armond and congratulate her on her new role as Accenture’s Insurance Lead for North America. We also welcome back Jim Bramblet as he moves into his new role as Accenture Financial Services Lead for the Midwest.

Our discussion begins with the recent developments in crypto and the expansion of cyber policies that protect insurance customers from losing their assets in the metaverse. While insurance in the metaverse continues to evolve, we consider how traditional home insurance is also evolving to include cyber coverage of personal devices.

The cost of commercial property insurance has increased to reflect the surging cost of construction due to factors like rising inflation and supply chain disruption. The impact is now reaching developers. New requirements in hurricane-prone areas like Florida are driving up builder’s risk insurance premiums.

Although the insurance industry now has 3 years of COVID-19 data to help inform underwriting decisions, it may not be enough to understand the risk the virus continues to pose. However, as consumers emerged from lock-down in 2022, we saw a major increase in demand for live events and consider what that means for customers and insurers.

How insurers can win the race to AI maturity | Insurance Blog

Artificial intelligence has been around since the 1950s, but over the last several years the business potential of AI has expanded dramatically. We now live in a world where big data and powerful computational capabilities allow AI to flourish. Companies—including insurance carriers—are investing in establishing data lakes, optimizing for cloud-based operations and activating AI for targeted analytics.

Insurers are seeing tangible results from their current AI initiatives. Our AI maturity research shows that carriers’ share of cost savings generated through AI more than doubled between 2018 and 2021. We predict that share will triple by 2024. Furthermore, insurers have been fairly satisfied with the return on their AI investments. Fifty two percent of insurance companies said the return on their AI initiatives exceeded their expectations, while only 3% said the return didn’t meet expectations.

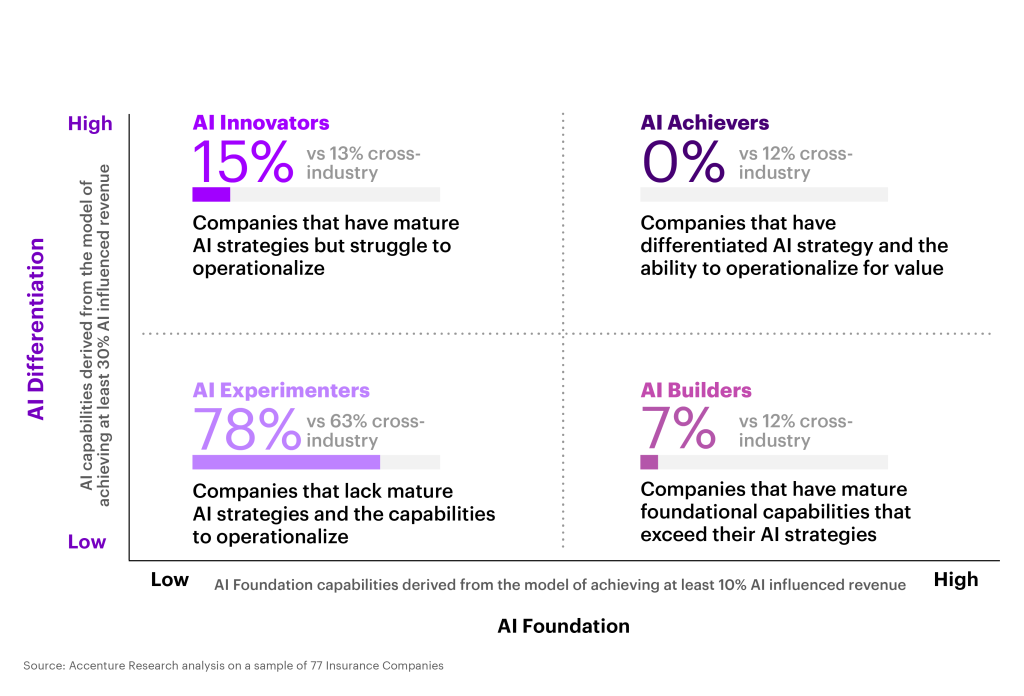

However, insurers are leaving value on the table. In our analysis of 77 insurance companies, we found that none of them were AI Achievers, which we define as companies that have a differentiated AI strategy and have operationalized AI to execute on that strategy. In fact, most insurance companies are in the AI Experimenter category, representing those who have the least-mature AI strategies and lack the capability to operationalize AI.

Insurers can move into the Achiever category to realize greater value by leveraging AI to power total enterprise reinvention. This includes employing AI in organization-wide decision-making and integrating AI into every part of the business—from business process optimization to delivering reimagined products, services and experiences to customers.

Carriers looking to gain momentum with their AI investments can find opportunities in the front office and build out their next phase of growth. Our study explored three key front office use cases that I’ll be diving into in this post: customer experience, product and service development, and sales and marketing.

Customer experience intelligence and journey automation

When it comes to customer experience optimization, insurers are beginning to make progress compared to other industries—yet they are still in the early stages of AI activation.

Many insurers have invested in developing a single view of the customer and have been able to understand what products customers own, if they have recently made a claim or whether they have received a quote for another product.

While some insurers are starting to gain a better understanding of the interactions they have with a given customer, most insurers struggle to connect the customer journey across multiple channels and touchpoints. Far fewer are able to use those insights to understand the breakpoints in that experience and address them systematically.

Though many insurers have invested in customer relationship management (CRM) platforms to share customer insights across the enterprise, few have layered in AI to use those insights to orchestrate highly personalized customer experiences that span marketing, sales, service and claims. Leading CRM vendors are integrating AI capabilities into their platforms, making it easier to embed out-of-the-box AI models into any workflow. Choosing such a technology is a major opportunity to create omnichannel experiences and build a truly holistic view of each customer.

When it comes to automating parts of the customer journey, conversational AI remains a largely untapped opportunity for the insurance industry as a whole. Those that are creating self-contained conversational experiences that satisfy customers’ needs—rather than simply answering FAQs or pointing customers to where they can get help—are generating higher levels of satisfaction with significant customer service cost savings and reduced reliance on a challenging labor market.

New product and service development

Recently, Accenture found that 88% of executives think their customers’ needs are changing faster than their businesses can keep up with. Factors like climate change and economic uncertainty are forcing customers to adapt to circumstances that are out of their control, moving through territory as they try to make the decisions that are best for them. Our research revealed a need for companies to shift from focusing on customer as consumer to developing a nuanced understanding of the customer as a multifaceted human being with complex and often contradictory desires.

This shift from customer-centricity to an approach we’ve coined “life-centricity” is especially relevant for carriers as they develop products. AI can help carriers widen their understanding of customer behavior and move outside of cookie-cutter customer profiles with data insights. It can help them build offerings that can be tailored to the needs and habits of customers as they move through their life, seamlessly recommending or upgrading individuals’ products to respond to events like the purchase of a new home or providing coverage as climate change reshapes natural disaster risk.

There are plenty of opportunities for insurers to create new products and services that use AI to realize more value and deliver enhanced experiences. We’re already seeing many carriers implementing AI in their auto insurance products to assess driver behavior and offer pay-as-you-drive policies.

As IoT and wearable technology improves, carriers will be able to use AI to gain an even deeper understanding of customer behaviors, meeting their needs and predicting what their needs might be in the future. With a deeper understanding of the customer, carriers can build products with a greater level of personalization, at scale.

My colleague Jim Bramblet has explored a few ways AI can provide another layer of protection for customers while gathering data about their risk profile and needs. One of the examples he discusses is an IoT-connected factory floor, where AI stops and starts machines as workers pass, notifies team members about parts that need maintenance and enables them to view potential hazards via AR glasses.

Sales and marketing intelligence, recommendations and process automation

Finally, carriers can leverage AI to enhance their sales and marketing performance. Throughout the marketing and sales funnel, carriers can implement AI to surface the most relevant recommendations to customers and address their questions in the moment. For example, UK business insurance company Tapoly uses AI at every customer touchpoint to offer tailored commercial line insurance products to their target market of micro-SMEs and freelancers. They also employ AI to optimize pricing and risk assessment based on customer data.

When customers want to speak directly to a live person, AI can streamline the human-to-human experience and increase the likelihood that the customer achieves the outcome they’re looking for. Agents will benefit from more data and insights at their fingertips, which means that they can seize upsell and cross-sell opportunities in the moment. Agents can rely on an AI assistant to surface the most relevant information in real time and make recommendations as they speak to a prospect.

Sompo has also partnered with AI CRM firm Vymo to build AI-enabled proactive sales coaching technology to improve the service that their team provides. Ping An has developed a similar solution that serves up relevant customer data as well as real-time coaching assistance that enhances agent performance.

How insurers can become AI Achievers

In our recent report, The Art of AI Maturity, we identified five key areas companies need to invest in if they want to realize the full potential of AI and seize the value that’s at stake.

- Ensure that leadership champions AI as a strategic priority for the entire organization. When it comes to transformation, everyone is a stakeholder. Leaders must ensure that their teams understand the value AI brings to their everyday tasks, and to the overarching business goals.

- Invest heavily in talent to get more from AI investments. Innovation comes from employing a diverse group of people to solve problems in unique and meaningful ways.

- Industrialize AI tools and teams to create an “AI core.” To scale AI, carriers need to create repeatable processes that create a strong foundation for increased innovation as time goes on.

- Use AI responsibly, from the start. AI ethics and governance needs to be at the center of every AI initiative as carriers scale. Today, only 35% of consumers trust how AI is being implemented by organizations. To retain customers, carriers must demonstrate transparency and minimize bias.

- Plan long- and short-term investments. There is no finish line when it comes to AI strategy and innovation. Customer needs will continue to evolve, as will AI capabilities. Those who plan ahead will stay ahead as the need to adapt increases.

AI’s potential in insurance is far from being fully realized, but carriers that take the initiative to build a strong AI program today will see a strong return from those investments. I would love to discuss how you can better leverage AI in your front office, so please don’t hesitate to get in touch with me.

Transforming claims and underwriting with AI: AI has emerged as the critical differentiator in the insurance industry when applied in tandem with humans.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.