ACA Open Enrollment 2025 – The Ultimate Guide

Autumn is here, and that means it’s time for pumpkins, apple cider, and the ACA annual open enrollment period.

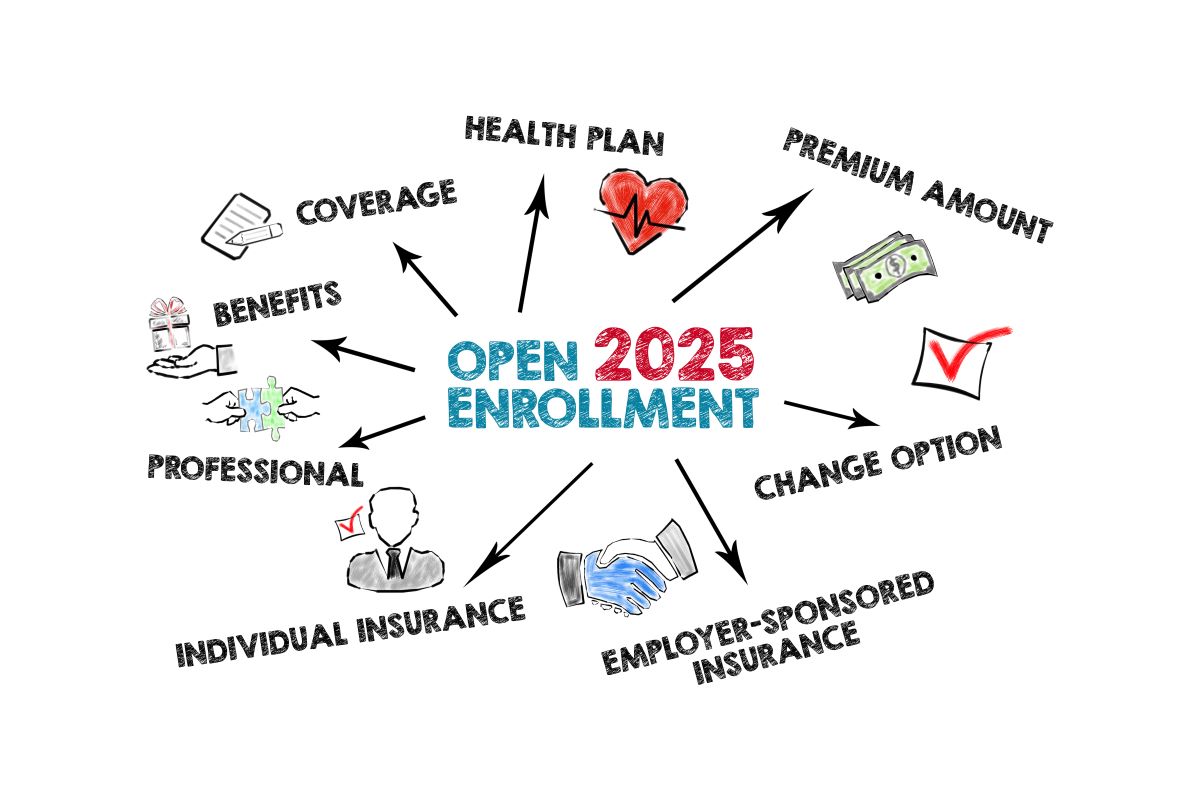

If you need to change your ACA health coverage — sometimes called “Obamacare” — this is the time to do it. You may add or remove dependents, change details, like your income or marriage status, buy a more comprehensive plan to suit your medical needs, or shop the insurance marketplace for more affordable health care options.

And the experienced team of insurance agents at Einsurance.com is here to help.

Today, we answer all your most frequent questions about ACA open enrollment period in 2025. Keep reading to discover:

First things first. If you only need to know the ACA open enrollment dates, find them below.

When is the ACA Open Enrollment for 2025?

If you need to make changes during open enrollment for 2025, note of these important dates:

- November 1, 2024, is the first day of ACA open enrollment

- December 15, 2024, is the last day you can make any changes to your health insurance for coverage starting January 1, 2025

- And January 15, 2025, is when the open enrollment ends and the last day to enroll in or make any changes for the year with coverage starting February 1, 2025

In other words, the changes you make this fall won’t affect your health plan until 2025.

Historically, these dates have been the same every year. Some state-run exchanges have different schedules. Please check here to make sure that you enroll on time.

During the ACA open enrollment period, you may:

- Add or remove dependents

- Look for a more affordable plan

- Shop for a more expensive plan that will cover your changing medical needs

- Or change other important details on your plan, like your address and phone number

Also, know that some states may extend or alter these dates if they provide state-run health plans. California residents, for instance, have Covered California, and the open enrollment period runs from November 1 through January 31.

Some consumers know they need to make changes to their health insurance plan, but they’re not sure who to contact or how to do it. If you’re not sure what sort of health insurance plan you have, let’s take a moment to sort it out.

Types of Health Insurance Available to US Residents

Americans may have group health insurance through their employer, a metal tier plan (Gold, Silver, Bronze etc.) through their state’s ACA insurance marketplace, Medicare (Medi-Cal), or Medicaid. It’s confusing, we know! Let’s take a glimpse at each type of health coverage.

What is ACA / Obamacare?

When President Obama signed the Affordable Care Act (ACA) into law in 2010, his goal was to make healthcare available for more Americans. Prior to that time, many consumers struggled to find health insurance because they had pre-existing conditions, were unemployed, or simply couldn’t afford any plans on the market.

Chances are, you have an ACA plan if you:

- Used the internet to buy health insurance through your state’s insurance marketplace

- Have a healthcare plan described as “Bronze, Silver, Gold or Platinum”

- Went to a local health insurance agent to buy a plan for yourself and your family, outside of any employment situation

One significant point of the ACA is the metal tier system. Understanding it will help you choose the right health insurance, and we’ve written about health insurance metal tiers extensively in the past.

The Metal Tier Plan for US Health Insurance

The metal tiers all reflect the same level of insurance across all providers. For example, a Bronze Plan sold by Company A is nearly identical to a Bronze Plan at Company B.

The same can be said for all Silver plans, all Gold plans and all Platinum plans. They will all offer the same coverage and deductible levels from one company to the next. The only difference is the price, so it pays to shop around.

Think of it like buying a can of Coca Cola. A can of Coke, from any place you buy it, will have the same ingredients. Some places charge more.

If you need to make changes to your ACA health insurance policy, you must do it during the annual open enrollment period. “Open enrollment 2025” starts on November 1, and depending on your state, may run through December 15, or a later date.

During open enrollment 2025, you can:

- Enroll or unenroll

- Change plan level

- Change provider

- Add or remove dependents

- Change key details of your policy, like your name or address

What is a Group Health Insurance Plan?

Group health insurance is usually offered through an employer. If you buy health insurance with a discount through your job, this is the type of insurance you have.

Federal & State Plans: Medicare, Medicaid, Medi-Cal

Medicare

Seniors aged 65 and older usually qualify for Medicare if they’ve paid into the system through payroll deductions throughout their lifetime. This is not ACA / Obamacare, and you can enroll in Medicare during a seven-month window around your 65th birthday.

Medicaid (Medi-Cal in CA)

Medicaid is a federal-state program for individuals with certain disabilities, low-income families, pregnant women, and others with unique needs. This is not part of ACA / Obamacare, and in California, it is called Medi-Cal.

Explore the table below to figure out which sort of health insurance you have, and how to reach those providers.

| If you have | You probably have | To make changes |

| Health insurance sponsored by your employer

Coverage through your spouse or parent’s job |

Group Health Coverage | Get the policy information from the HR department at the employer who sponsors the plan.

Get a copy of the policy and contact that provider with your policy number. |

| Health insurance bought through your state’s insurance marketplace | ACA / Obamacare | Look at your current policy for a toll-free number to call.

If this is your first time enrolling, do an online search for “ACA Insurance in [your state]” or contact a licensed health insurance agent. |

| Medicare – the federal plan for seniors age 65+ | Medicare | Medicare.gov |

| Medicaid – a federal and state run plan for low-income individuals, those with certain disabilities and illnesses | Medicaid | Medicaid.gov |

There are a few other types of health insurance available. Active duty service members, veterans and their families may have TRICARE. If you have TRICARE, you don’t need to enroll in Obamacare.

About Healthcare Open Enrollment 2025

Regardless of the type of health insurance you have, autumn is the time to make changes. The “health insurance year” runs concurrently for all plans. In other words, the Medicare open enrollment for 2025 runs at the same time as group insurance open enrollment, which is the same as Obamacare open enrollment.

It’s a busy time of year for health insurance agents!

When Do Children Get Their Own Health Insurance?

Currently, children can stay on their parents’ health insurance plans until they are 26. They do not even need to live with their parents to keep this coverage.

However, once you hit that milestone, you will need to find health insurance yourself. You can do that during the ACA open enrollment period, which begins November 1.

Now, let us discuss how to enroll for ACA health insurance / Obamacare if this is your first time.

How to Apply for Obamacare by Myself

If this is your first time applying for health insurance, you might feel intimidated. Fear nothing! The professionals at Einsurance are here to walk you through the process.

First, note the dates. The health insurance open enrollment period begins November 1. We suggest you make this a priority before the holidays go into full swing. We’ve seen many consumers get overwhelmed with holiday activity and forget to make their important health insurance deadlines.

Next, gather your documents. You will need:

- Your Social Security number (though not always)

- Your ID card

- A good mailing address

- Any prescriptions you take regularly (this can help you decide which plan to buy)

- And your doctor’s name if it is important that you stay with the same provider

Then, use the internet to search for “Health Insurance in [your state].” Or try our handy online quoting tool at Einsurance.com. We can match you with insurance agents offering affordable health insurance.

Buying Health Insurance: Which Metal Tier Plan Should I Choose?

As licensed insurance agents, this is a question we get a lot during the open enrollment for health insurance.

But we are all individuals, and there is no set formula that says, “buy this plan at this age.”

However, if you are young and healthy, a Bronze plan will offer the lowest monthly payments. But remember, expensive prescriptions, therapy, surgeries, and healthcare visits will cost more.

Conversely, if you’re older, have several health issues and take several expensive medications, a Gold or Platinum plan may be a better choice. These plans cost more every month, but they cover more of your needs.

You may prefer a more expensive monthly premium if you’re living with a health condition such as:

- Heart conditions

- Kidney conditions

- A history of cancer

- Respiratory disease, like mesothelioma

- Diabetes

- Dementia, Alzheimer’s, or Parkinson’s diseases

Remember to get several quotes! All Bronze plans will cover the same things, but the prices can be different from one provider to the next.

Can I Keep My Doctor if I Change Health Insurance During Open Enrollment?

This is another common question, but we cannot answer it directly.

If staying with the same doctor is important, you need to ask them which insurance they accept. Some only take Medicare, others only work with ACA / Obamacare plans. Some only work with a few select insurers in their area. It just depends on your doctor!

Luckily, this is an easy call to make. The office staff will know which insurers they accept, so give them a call.

More About State-Run Health Insurance Marketplaces

The Affordable Care Act — Obamacare — is a federal system. But every state can create their own health insurance marketplace.

According to Healthcare.gov, the following states and districts are offering websites with state-run plans:

- California

- Colorado

- Connecticut

- Washington DC

- Georgia

- Idaho

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Nevada

- New Jersey

- New Mexico

- New York

- Pennsylvania

- Rhode Island

- Vermont

- Virginia

- Washington (state)

Note that Georgia is offering a state marketplace for the first time for 2025. If you are a Georgia resident looking to enroll in Obamacare during this open enrollment period, you can do it online, or contact the team at Einsurance for fast, affordable healthcare quotes.

Finally, let’s explore a key point about health insurance options and the open enrollment period. We’re talking about prescription medications and formularies.

What is Formulary? Does it Matter to Me?

Earlier in this piece, we mentioned the importance of your medications when choosing a health insurance plan during the open enrollment period 2025. This is because insurers keep formularies — lists of prescriptions they will cover at X prices — and you need to know your medication is covered.

Remember that all metal tier plans are equal. They all cover some types of antibiotics, some types of pain medications, and certain other common drugs. It’s the price you’ll pay from one insurer to the next that is the main difference.

However, some prescriptions are not available in generic forms and others aren’t covered without paperwork from your doctor. It can get complicated, but in short, if you take several medications, be sure to mention these when shopping for health insurance during the ACA open enrollment period 2025.

You might discover it’s better to buy a more expensive tier (say, a Silver or Gold plan), or work with a certain insurer who covers your specific drugs.

7 strategic cyber steps for the Chief Underwriting Officer | Insurance Blog

Cyber is an expanding net-new growth area with opportunity to deliver a compelling insurance offering especially in the mid-market. Yet, the path to becoming a market-leading and profitable cyber insurer is fraught with challenges. In this article, we outline the essential strategies to develop a top-tier cyber offering, culminating in a guide to the 7 strategic cyber steps for the Chief Underwriting Officer.

Why cyber in the mid-market has unique challenges to mitigate

The cyber risk landscape is evolving so rapidly that insurers need a robust framework to for example enable continuous data-led learning from previous claims, deliver a seamless quote and bind process, and to mitigate unintended risk aggregation.

While the SME market will typically purchase standard cyber coverage direct and online, the mid-market consists of companies that are serviced by brokers and agents. These companies require insurers to possess both foundational and advanced capabilities to effectively address the unique challenges of cyber risk in the mid-market. The key challenges that are unique to cyber in the mid-market are as follows:

Transparency and clarity for brokers and agents: As the mid-market is predominantly serviced by brokers and agents, it’s crucial that the insurer’s risk appetite and underwriting approach are transparent. Whether the insurer offers a dedicated cyber broker portal or utilizes existing portals for multiple lines of business, the key is to have a transparent risk appetite and to make it seamless for brokers to compare quotes and to place business. Additionally, it is imperative to turn around accurate quotes on a same-day basis.

Need for both standard and bespoke policies: The mid-market consists of companies that purchase both standard and bespoke policies. Insurers therefore need to be able to quickly turn around changes to policy terms, changes to exclusions, or a different mix of higher deductibles or sub-limits. Some mid-market companies have sophisticated requirements on risk mitigation, prevention and incident response planning. For large mid-market customers there can be a need for in-depth exposure analysis to design the right insurance coverage.

Significant amounts of data: Whilst no more than four data points are required from an SME customer for a standard cyber policy (name, industry, revenue, and the customer’s website), far more data points are required by mid-market customers. Some data points can be obtained through open APIs and structured data intake from brokers, but the higher complexity of the risk, the higher the likelihood is for the relevant data points to arrive in unstructured documents.

Establishing a robust digital infrastructure for cyber insurance

Cyber insurers need foundational capabilities across distribution, quote, and bind to ensure a seamless business process. The operating model begins and ends with being focused on the customer and broker experience. Whether insurers choose to organise themselves according to the customer segment (e.g. a mid-market Center of Excellence servicing all lines of business) or according to the lines of business (e.g. a specialized one-stop-shop cyber team cutting across distribution, underwriting, and claims), it is important that this is a conscious choice made at the C-level.

All customers, irrespective of whether they purchase cyber insurance, should quantify their cyber risk and define their key cyber risk scenarios as part of their incident response planning. If they do not, they are running an unknown and potentially significant risk through the balance sheet. Some insurers may choose to invest in risk scenario capabilities, whereas others will rely on brokers or outsource to cybersecurity experts. The capabilities required for an in-depth exposure analysis is similar to what some insurers offer in a cyber saferoom that provides a secure space for pre-incident advice and training, cyber stress-testing, cybersecurity readiness verification tools, detection and response solutions, incident response planning, notification services and embedded claims services.

A key foundational capability for cyber is a strong digital core and master data management that is fit-for-purpose. Insurers require strategic tools like a robust digital core and fit-for-purpose master data management to perform detailed exposure analysis at the quote stage. These tools facilitate granular risk accumulation and establish a framework for measuring and understanding aggregated cyber risk exposure based on various parameters, including industry sector, underlying hardware and software, cybersecurity maturity, supply chains, jurisdiction, and company size. A detailed exposure management framework is crucial for effectively mitigating the risk of unintended risk aggregation.

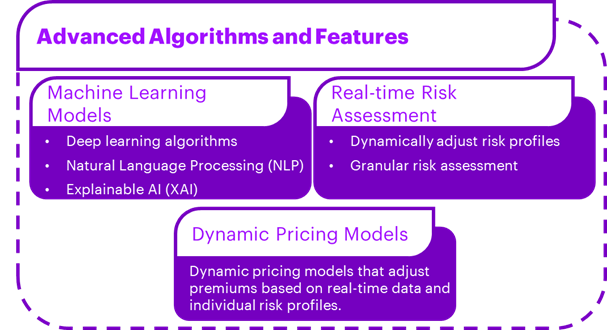

Building advanced market leading cyber capabilities

A critical component to becoming a market-leading cyber insurer is that the technology and data capabilities must be architected to work at scale and in real-time. Cyber insurance is among the most challenging sectors due to the potentially catastrophic and boundary-less nature of breaches. Cyber incidents can be continuously evolving and unpredictable, akin to oil spillages, and can critically impact businesses, societies, and essential infrastructure like hospitals, water and sewage systems, and airports. Today, the potential for insurers to face unintended risk aggregation is a clear and present threat.

As mentioned above, significantly more data points need to be captured and modelled at the quote and bind stage for mid-market cyber policies. Additionally, at first notice of loss, there can be hundreds of relevant data points, which is far more than for example with a motor claim, where insurers typically capture 20-30 data points that are motor specific (vehicle details, purpose of use, witness details, IoT data etc.). For a cyber claim there are more than 100 data points that can be relevant for the continuous learning and refinement that feeds into exposure management, the actuarial tables, and the risk controls in the underwriting system. This in turn is what enables a market-leading insurer to remain profitable through a robust framework around risk appetite and pricing.

As previously covered, there is a scarcity of cyber talent with deep proficiency in cybersecurity protocols and a deep understanding of the constantly evolving regulations and legislation across IT, AI, GDPR, and consumer privacy. Whilst investing in talent and continuously upskilling underwriters and claims adjusters, there are high-impact use cases in cyber insurance for AI and Gen AI solutions. We have seen AI and Gen AI save underwriters tens of hours a month and empower them to only spend their time on niche and hazardous risk areas that require deep human expertise.

Insurers with a strong digital core can move quickly on accelerating profitable growth in cyber, but most insurers are coming to the realization of the investments needed to implement AI and Gen AI at scale. Per Accenture’s Pulse of Change research, 46% of insurance C-suite leaders say it will take more than 6 months to scale up Gen AI technologies and take advantage of the potential benefits. If applications and data are not on the cloud, and if there is not a strong security layer, then benefiting from Gen AI at scale is virtually impossible.

The 7 strategic cyber steps for the Chief Underwriting Officer

In today’s rapidly evolving technology landscape, Chief Underwriting Officers face the critical task of steering their organizations through the complexities of cyber insurance. The following strategic steps are a roadmap for insurers to not only survive, but thrive in this challenging environment:

- Define your identity in cyber insurance: Decide whether you want to be a conservative insurer, a fast follower, or a market leader. This choice will guide your investments and emphasize cyber as a core part of your business.

- Establish your cyber brand: Determine your signature offering in cyber insurance, whether it’s leading-edge risk consulting, competitive pricing, AI-powered and streamlined processes, or a strong reputation in claims service.

- Opt for specialization: Choose between establishing a dedicated mid-market Center of Excellence (CoE), a cyber-specific CoE, or a hybrid operation model.

- Enhance responsiveness: Transform or deploy new capabilities to deliver accurate quotes within a few hours.

- Refine underwriting practices: Decide on the optimal number of underwriting variables for technical pricing. Reverse-engineer your processes to capture essential data at the broker submission and claim notification stages.

- Assess cyber exposure management: Engage external experts to evaluate your cyber exposure management helping to avoid unintended risk aggregation.

- Invest in talent: Focus on a talent strategy that enhances skills and integrates advanced technologies like AI and Gen AI to keep pace with the evolving cyber risk landscape.

Measuring the path to being a cyber market leader

Designing and executing a leading framework for cyber insurance presents significant challenges. A crucial aspect involves defining success, establishing metrics for measurement, and determining the necessary actions to achieve these goals. Continuously monitoring financial and operational metrics is essential for timely adjustments, ensuring the capture of profitable growth in the cyber mid-market. For further discussion, please contact Carmina Lees and Matthew Madsen.

Bicycle Accident Insurance – What Cyclist Ned to Know

Key Takeaways:

- Cyclists involved in accidents with motor vehicles may be covered by the driver’s car insurance policy, including UM/UIM coverage.

- While home insurance provides some protection, it may not cover all risks associated with bicycle accidents. Cyclists should evaluate their policies and consider additional coverage options to close the gaps in protection.

- Specialized bicycle insurance policies offer comprehensive coverage that extends beyond what’s provided by home or auto insurance, making them an excellent option for serious cyclists.

- Innovative insurance products are emerging that cater specifically to cyclists, offering more tailored and flexible coverage options.

Cycling has gained immense popularity in recent years, driven by trends like eco-friendly commuting, fitness, and urban congestion relief. It’s estimated that over 730,000 Americans bicycle to work daily with that number exploding exponentially on ‘National Bicycle to Work Day’, held in May of each year.

However, as more people take to the streets on bikes, the risk of accidents increases. According to the National Highway Traffic Safety Administration (NHTSA), over 857 cyclists were killed in 2023 in the U.S., while thousands more were injured.

The Rising Need for Bicycle Accident Insurance Coverage

With the rise in cycling accidents, the topic of bicycle accident insurance coverage is becoming more critical. Many cyclists don’t realize that the same protections available for cars are often available to them, or that there are specialized policies designed to meet the unique needs of riders. Whether you’re commuting or riding for leisure, understanding your options for insurance coverage is key to being prepared for the unexpected.

In this definitive guide, we explore the ins and outs of insurance coverage for cyclists, starting with general policies, specialized coverage, and how existing insurance policies like homeowners or auto insurance come into play. We will dive into solutions and strategies for ensuring you’re fully covered in the event of a bicycle accident.

Standard Car Insurance and Bicycle Collisions—How Auto Policies Can Help Cyclists

Standard car insurance policies can often provide coverage for cyclists in the event of a bicycle collision, particularly if the collision involves a vehicle. While auto insurance is primarily designed to cover motorists, many policies include provisions that extend protection to cyclists in certain circumstances.

For example, if a cyclist is hit by a car, the driver’s liability coverage typically applies, helping to cover the cyclist’s medical expenses, property damage (such as the bike itself), and other related costs. In cases where the driver is at fault, their bodily injury liability coverage may also provide compensation for the cyclist’s injuries.

In addition to liability coverage, cyclists may also benefit from uninsured or underinsured motorist coverage, which is another feature of many standard car insurance policies. This type of coverage can be essential if the at-fault driver has insufficient insurance or none at all.

If a cyclist is involved in an accident with an uninsured motorist, their own uninsured motorist policy, if included in their auto insurance, can step in to cover medical bills and other expenses. This extension of coverage is particularly useful in hit-and-run scenarios, where the driver may flee the scene, leaving the cyclist without a responsible party to claim against.

Beyond medical expenses, car insurance policies can also provide financial protection for the cyclist’s property. For example, collision coverage may cover the cost of repairing or replacing the bicycle if it is damaged in an accident with a motor vehicle. This can be especially beneficial for cyclists who use high-end or custom bikes, which can be expensive to repair or replace.

Although auto insurance isn’t specifically tailored for cyclists, it can still play a crucial role in helping them recover from accidents involving motor vehicles.

Does Home Insurance Cover Bike Accidents? Unpacking the Coverage Limits

Home insurance policies typically offer some level of coverage for bike accidents, but the extent of that coverage can vary greatly depending on the specifics of the policy.

Generally, a standard home insurance policy includes personal property coverage, which may protect your bicycle if it is stolen or damaged due to a covered peril, such as fire, theft, or vandalism. However, this coverage is often subject to limits, meaning the insurance might only reimburse up to a certain amount, and in some cases, you may need to pay a deductible before the coverage kicks in. Accidental damage to your bike while riding, on the other hand, is usually not covered under a typical home insurance policy.

When it comes to personal liability, which is another component of home insurance, your policy may provide protection if you’re held responsible for causing injury or damage to others while riding your bike.

For example, if you accidentally crash into someone and they file a lawsuit against you, your home insurance could help cover legal fees or medical costs. However, it’s important to note that this coverage often comes with limits, meaning your insurance will only cover up to a certain amount, and you may need to pay the difference if the costs exceed that limit.

It’s crucial to review your policy’s specifics and consider additional insurance if you use your bike frequently or own a high-end model. Some insurers offer bicycle-specific coverage as an add-on or through a separate policy, which can provide more comprehensive protection, including for accidents, theft, and liability while riding.

These policies typically have higher coverage limits and may even include roadside assistance for cyclists. Additionally, if you use your bike for work or delivery services, you’ll likely need commercial insurance, as standard home insurance policies often exclude coverage for business-related activities.

Specialized Bicycle Insurance Policy—Tailored Protection for Serious Cyclists

For those who frequently cycle or own expensive bikes, a specialized bicycle insurance policy is worth considering. Unlike general home or auto insurance, these policies are designed specifically to cover the needs of cyclists, offering comprehensive protection for accidents, injuries, and even theft.

Specialized bicycle insurance policies typically provide coverage for:

- Accidents involving vehicles, pedestrians, or other cyclists

- Damage to the bike itself, including repairs or replacement

- Medical costs resulting from a cycling accident

- Liability for property damage or injuries to others

These policies may also include additional benefits such as roadside assistance for cyclists and coverage for race-related incidents. For dedicated cyclists, this tailored protection offers peace of mind that their bike and health are adequately insured, no matter the circumstances of an accident.

Personal Liability for Cycling Accidents

Accidents happen, and sometimes, cyclists may be at fault and personal liability for cycling accidents can have a major financial impact. Cyclists should ensure they have adequate liability coverage to protect against costly lawsuits and claims.

Whether it’s colliding with a pedestrian or damaging someone’s property, cyclists may find themselves responsible for covering the costs of these incidents. This is where personal liability insurance becomes essential. If a cyclist causes an accident that results in injury or property damage, personal liability insurance can help cover the associated costs.

However, many cyclists assume that liability coverage is only necessary for car owners. This misconception can leave cyclists vulnerable, especially in situations involving serious injuries or high-value claims. Without adequate personal liability insurance, cyclists could face expensive lawsuits, hospital bills, and repair costs.

Trends and Innovations in Cycling Insurance for 2025

With cycling becoming more mainstream, the insurance industry is developing innovative solutions to meet the evolving needs of cyclists. Companies are creating new insurance products tailored specifically to cyclists, offering hybrid plans that combine elements of auto, health, and personal liability insurance.

Additionally, technology-driven solutions such as telematics and app-based policies are allowing cyclists to track their riding habits, earn discounts, and access coverage on demand.

In the event of an accident, some of these products offer immediate support through mobile apps, providing cyclists with assistance for filing claims, roadside help, and even emergency medical coverage. This shift toward specialized and tech-forward insurance products represents a growing acknowledgment of the unique risks faced by cyclists and the need for comprehensive solutions.

Protecting Yourself—Why Bicycle Accident Insurance Coverage is Essential

As cycling continues to grow in popularity, so does the importance of adequate insurance coverage. Cyclists face unique risks on the road, including accidents with motor vehicles, pedestrians, and other cyclists. By securing bicycle accident insurance coverage—whether through auto insurance, homeowners insurance, or a specialized policy—cyclists can protect themselves from financial hardship in the event of an accident.

It’s not enough to rely on basic coverage from home or auto policies. Cyclists should take the time to evaluate their insurance needs, consider specialized policies, and ensure they have comprehensive protection. With the right insurance, cyclists can ride with confidence, knowing they are prepared for any situation.

Securing proper insurance coverage is essential for protecting yourself as a cyclist. Review your current policies and explore specialized options to ensure you’re adequately covered.

Shopping for Insurance Quotes to Get the Best Value

Obtaining insurance quotes through an insurance marketplace, such as einsurance.com, is a straightforward and convenient process designed to help consumers compare multiple insurance options in one place. These websites offer a platform for users to request quotes for various types of insurance, including auto, home, health, life, and renters insurance.

To begin, users input basic information about their insurance needs, such as details about the property, bicycle, vehicle, home, or personal coverage they are seeking. Once the necessary details are provided, a quote engine connects users with insurance companies that offer policies matching their criteria, allowing them to compare quotes side by side.

One of the advantages of using einsurance.com is the speed and ease with which quotes are generated. Instead of manually visiting individual insurance company websites or speaking with multiple agents, users can receive a wide range of options in a matter of minutes.

The platform partners with reputable insurers, ensuring that users are presented with legitimate offers from well-known providers. By reviewing multiple quotes in one place, users can easily identify the best value based on factors like premium costs, coverage options, and deductible amounts.

Additionally, as an example, einsurance.com offers outstanding educational resources to help consumers make informed decisions about their insurance needs. The platform provides articles, guides, and tools that explain key insurance terms, coverage types, and tips for reducing premiums.

This added value helps users better understand the insurance process, ensuring they choose policies that align with both their needs and budget.

PRO TIP: While the insurance marketplace can facilitate the quote comparison process, the actual purchase of insurance is typically completed through the insurer’s website or with the assistance of an insurance agent.

Summing Up Comprehensive Coverage for Cyclists

Cycling offers numerous benefits, from improved health to environmental sustainability, but it also comes with inherent risks. Bicycle accidents can lead to serious injuries, property damage, and significant financial burdens. The right insurance coverage can mitigate these risks, providing financial protection and peace of mind for cyclists.

Whether through auto insurance, homeowners policies, or specialized bicycle insurance, cyclists should prioritize understanding their coverage options and taking steps to fill any gaps. As the popularity of cycling continues to rise, the need for comprehensive insurance solutions is more important than ever.

In conclusion, insurance coverage for bicycle accidents is not just a good idea—it’s essential for anyone who spends time on a bike. By investing in the right policies and staying informed about available options, cyclists can ensure they are fully prepared for whatever the road may bring.

Connect with einsurance.com to learn more about your options to stay safe on the road.

Why You Need to Update Your Homeowners Insurance Before Renting Out Your Property

Homeowners and landlords use their property differently, so they face different risks. That’s why several distinctions exist between homeowner’s insurance and landlord insurance.

For insurance purposes:

A homeowner lives in a primary residence full-time. They own the home completely or make a mortgage payment. Usually, they keep most of their belongings at this home, too.

A landlord rents/leases the property out for use to another party for long-term residency. Landlords keep very few belongings at the home, beyond things like appliances, light fixtures and perhaps lawn care machinery.

And for short-term rentals — like Airbnb properties — there is another sort of insurance available.

Who Needs Landlord Insurance?

If you’re about to become a landlord by renting out a home that was previously your main residence, or a home you inherited, it’s vital that you buy landlord insurance. You need to make sure you have the right coverage at the rental property to protect yourself, financially.

And, since you’re making changes to your property insurance, it’s a good idea to shop around for several quotes. You may find significant savings!

At Einsurance.com, our experienced team of licensed insurance agents works hard to match consumers with the right insurance products. In this piece, we’ll explain everything you need to know about landlord insurance versus homeowner insurance.

Keep reading to learn about:

We’ll start with some important key points that apply to both landlord and homeowner’s insurance policies.

Landlord Insurance Vs. Homeowner’s Insurance

Both landlord insurance policies and traditional homeowner insurance policies are built on the notion of fire coverage. Both types of policies will pay — up to policy limits — to rebuild a home after it burns down.

This is called “Coverage A,” the cost to rebuild a home from the ground up. Insurers use formulas to figure your Coverage A amount, and many other coverages are based on a percentage of that number.

Both landlord insurance and homeowner’s insurance also cover perils like:

- Wind damage

- Hail damage

- Lightning damage

- Malicious mischief

- Civil unrest and riots

- And airplane crashes

And generally, neither policy will cover earthquakes or floods. For those perils, you’ll probably need to buy an “endorsement” or a separate policy.

What is the Difference Between Landlord Insurance and Homeowner’s Insurance?

For the consumer, there are three primary distinctions between a landlord policy and a homeowner policy. They are:

- Contents coverage amounts

- Liability issues

- Income protection

Contents Coverage Differences

First, a landlord policy does not offer much coverage for the contents of a structure. In other words, if this rental home burns down to the ground, a landlord policy will not cover things like furniture, clothing, cosmetics, electronics, tools or computers kept at the home.

The assumption is that most of the contents in the home belong to the tenant, not the landlord. And the tenant can buy renter’s insurance to cover their belongings.

Coverage “C” is For Contents

This is different from a homeowner’s insurance policy, in which Coverage C equals 30% to 50% of your Coverage A. This contents coverage exists to replace your belongings after a covered peril.

So, for instance, if your primary residence is valued at $200,000, your policy may provide another $100,000 after a total loss, to replace all your stuff.

Pro tip: If you plan to rent out this home as completely furnished, be sure to mention that when getting quotes for landlord insurance. You may wish to buy extra contents coverage.

Liability Issues

As a landlord, you will face more liability issues. We live in a very litigious society, meaning that people like to sue each other whenever they can for a fast paycheck. And if your tenant, or their guest, gets hurt on your property, you will probably find yourself in court.

Remember, in the insurance world, “liability” equals financial responsibility.

If a tenant gets hurt, or if their property gets damaged through your negligence, you will be financially responsible to make them whole again. Liability coverage exists to protect you from lawsuits.

In some cases, your liability insurance will “settle” with a claimant and write them a check. In other cases, they’ll help pay an attorney to represent you in a lawsuit. It’s up to the insurer to decide what path they take.

Therefore, many landlord policies include extra liability coverage. And often, landlords choose to buy as much liability as they can afford.

Pro tip: If you’ve bought the most liability coverage available for your properties, and still feel you need more coverage because you’re a high-net-value individual with lots of assets, you can buy an added liability coverage with an umbrella policy.

Landlord Policies Help Protect Your Income

And finally, know that a landlord policy can help protect your rental income after a covered loss.

Suppose you’re earning $1,500 per month on a rental home. One day, it burns down completely. Your landlord protection policy might cover that rental income for up to a year, in addition to paying to rebuild the structure.

If it takes a whole year to rebuild the rental, that’s $18,000 of income you could miss without landlord insurance.

Now that you know the differences between landlord insurance and homeowner’s insurance, let’s talk about rental property insurance requirements.

Rental Property Insurance Requirements

Rental properties are not your main residence, nor are they a second home or summer home where you might spend time occasionally. They’re not short-term rentals (Airbnbs), either. Insurers consider them to be commercial properties, which exist to generate income for you.

Now, every state has slightly different laws and every insurer presents a slightly different offering. As of 2024, there is no state law or federal law that requires landlords to buy insurance for a rental property. But if you’re making a mortgage payment on the place, the mortgagee may require you to carry property insurance with a specific deductible.

You May Need to Provide Documents

As a landlord buying insurance, you will probably need to provide some photos and documents proving that a rental home is:

- Owned by you, but habited by others

- Being bought through a mortgage or owned outright

- Habitable, and in good repair

- Free of dangerous debris, like fallen tree limbs or broken glass

- Essentially safe

- Free of fire risks or other common property claims

When you buy a landlord policy, you can expect the insurer to send out an inspector to verify everything you’ve said about the residence.

What Does an Insurance Inspector or Risk Inspection Specialist Do?

These individuals are employed/contracted by insurance companies to verify the risks an insurance company is about to take with your home. They may call for an appointment, or they may view the home from the street. Depending on the insurer, the inspector may ask to enter the property to look around and take photos.

Sometimes they measure the structure, to help insurers generate that important Coverage A amount. They may also have questions about the:

- Roofing

- Flooring

- Plumbing

- Fire extinguishers

- And fire exits

And in 2024, we know many insurers are using drone technology to view and photograph homes and yards.

The insurance company will also need to know about your expected income. You may need to provide them with a copy of the signed lease, which details the monthly rent.

It is a small hassle, which is one reason why some property owners try to dodge the landlord insurance process. Some try to keep their traditional homeowner policy while moving to a new home, and that’s a bad idea.

Let’s explore more about changing insurance when renting out a home, to see what we mean.

Changing Insurance when Renting Out a Home

Imagine you own a small home outright, and you inherit another, larger, newer home. You choose to move into the large new home and rent out the old place. This is a fairly common situation.

Can I Have Two Homeowner Insurance Policies at Two Addresses?

Usually, no. And insurance companies will “die on this hill.”

Most insurers believe firmly that consumers should only have one homeowner’s insurance policy. That’s because you only have one primary residence. You can buy other types of policies for your vacation homes, summer homes, hunting camps or short-term rental properties.

Insurers will stand firm on this point. Therefore, if you contact your insurer and try to buy a second home policy, they might refuse. And they might wonder what you’re doing and send an inspector around just to check.

But it truly makes more sense to get a landlord policy for that rental, anyway. Thanks to the reduced contents coverage, it might be much more affordable to insure a property that way, by hundreds of dollars. That means more money in your pocket every month.

Plus, if something happens to that property, you will rest easy knowing your income is protected.

And as a property owner, you want to protect yourself with the right amount of liability coverage, especially now that you have more assets to lose.

(By the way, we have seen one family go to battle with an insurer over this very point. The customers own many rental homes and allow an adult child to live in one home rent-free. It took several meetings, and they hired an attorney, but they were able to buy two homeowner policies from one company.)

The Process for Changing from Homeowner’s Insurance to Landlord Insurance

If you’re moving out of a home and making it a rental property, you need to let your insurance company know right away. You’ll probably save some money by doing so.

Just grab your current policy and call your insurer. Get a quote for landlord insurance, but don’t accept the first offering. Be sure to shop around. You might save a lot!

We invite you to try our handy online insurance quoting tools, too. We can bring dozens of insurers to your phone or email with very competitive prices.

More About Home Insurance Coverage for Rental Properties

You’ve read this far, so you’re becoming an expert on the differences between home insurance policies and landlord policies. Let’s answer some more of your most common questions.

Can I Buy Landlord Insurance for my Airbnb?

Short-term rentals, like Airbnb, do not qualify as traditional rental properties. They are income properties, but they’re more like a hotel in the eyes of the insurer.

Insurance policies for these types of investments continue to evolve, but underwriters know there is a difference between how people treat a home compared to how they may behave while on vacation.

Therefore, short-term rental insurance requires a separate product.

Can I “Bundle” my Home Policy and Landlord Policy?

Probably, yes. If you have a home policy, you can almost certainly buy a landlord policy from the same company. And if you have vehicles, recreational vehicles and boats, you may save a few bucks this way. But it still pays to shop around and keep detailed notes.

At What Point Should I Consider an Umbrella Policy?

Now that you own several properties, you should start thinking about a personal umbrella policy. These policies provide you with extra liability coverage, assuming you’re already buying the highest limit of liability on your home, rentals and auto policies.

In short, an umbrella policy will pay for liability claims beyond your current limits. So, if you have $1 million in liability coverage on a rental home, but get sued for $2 million, an umbrella policy will cover that difference.

There is no set number of properties or predetermined amount of personal wealth you need to buy this sort of policy. However, if you think you could get sued for more than your insurance will cover, or if you have a lot of assets, or even if you’re losing sleep worrying about this question, we invite you to get a quote for umbrella insurance, too.

Navigating the next era of growth in insurance brokerage | Insurance Blog

The brokerage market has enjoyed a period of sustained revenue growth, profitability, and shareholder value, driven by favorable macroeconomic conditions. M&A activity has flourished due to easy access to inexpensive capital on a robust cash flow business, while organic growth has been fueled by a hardening rate environment and inflation-driven exposure increases. Shareholder value, including that of financial sponsors and employees, has also been bolstered by a liquid capital market and historically high multiples, marked by a record number of transactions. However, these tailwinds are moderating as market conditions shift.

The surge in interest rates, record-high valuations, and tightened access to capital have created significant headwinds for M&A activity, with deal flow declining by about 30% through the first 8 months of 2024 compared to the same period in 2023. Despite this slowdown, M&A remains a crucial strategy for brokers to stay competitive in their offerings to clients and maintain their negotiating power with insurance carriers. Similarly, brokers’ organic growth, driven largely by increases in rate, over the past several years—averaging around 8 to 9% in annual revenue—is beginning to compress as P&C rate hikes moderate in some lines of business. Further, the average revenue of top 100 brokers and agencies held by private equity has nearly doubled in the past four years indicating that it takes more capital than ever to create liquidity events for the largest aggregators.

As the macroeconomic tailwinds begin to moderate, a critical question emerges: How can insurance brokers evolve their strategies to usher in the next era of profitable growth?

There are three longer-term levers the C-suite is exploring to create and sustain profitable growth:

- Drive a greater degree of standardization and integration

Brokerages that operate with a highly federated model or function more as a holding company rather than an operating company often allow their underlying agencies to operate independently. While this approach offers flexibility and can promote an entrepreneurial spirit, it also leads to operational inconsistencies, disconnected technology systems, disparate data sources, and challenges with governance and controls. As the market evolves, brokerages are increasingly seeking to standardize ways of working and introduce a higher degree of integration in their operating models. This shift involves adopting a global redesign to establish uniform definitions and rethinking how enterprise-wide processes should be managed to enhance quality and controls.

Further, process standardization and agency integration must be anchored by an integrated technology ecosystem spanning business segments and functional groups to enable traceable data flow throughout the organization and create a single source of truth for managing the business. Tighter integration and standardization form the foundation for improved efficiencies and the ability to generate greater insights to drive growth:

- Greater enterprise leverage and margin preservation: Standard operating procedures and tighter integration enable brokers to better consolidate non-client-facing activities. Back-office functions such as accounting, IT, and HR can be shifted out of the agency office to create efficiencies and enable greater focus on sales and service initiatives.

- Optimized procurement and indirect spend: Acquired agencies typically come with their host of technology licenses and third-party vendors; a greater degree of integration allows consolidation of fragmented vendor and licensing agreements, gaining economies of scale with a targeted vendor list. Additionally, efforts to drive operational standardization will introduce opportunities to normalize discretionary spending, such as reducing side tech projects or solution workarounds.

- Improved data-driven decisions and accountability: With accurate, available data, operators can govern their business on a distinct set of insights with a clear understanding of what, how, and why each insight is measured, including how frontline colleagues, who operate much of the business, impact enterprise performance. The shift to fact-based decision-making creates focus and enables leaders to take calculated actions with measurable results, reducing the need for broad, ill-defined moves that often negatively impact margins – and creates clear accountability for what information needs to be captured in a consistent fashion, enabling the enterprise to harness the insights useful to the enterprise and the field.

- Activate new sources of growth:

With more restrictive M&A conditions and moderating tailwinds from renewal pricing increases, brokers need to be strategic about where to invest in growth. Driving organic growth through data is essential, deploying strategies and tools like Generative AI to gain deeper insights for revenue-generating roles (e.g., leveraging Gen AI to identify cross-sell/up-sell opportunities across the brokerage book of business). Activating synergistic revenue streams by prioritizing investments in new capabilities (e.g., focusing on M&A that brings new products or geographic coverage), enhancing scale within existing markets, or exploring vertical integration opportunities should be key areas of focus moving forward. We also see brokerages differentiating themselves through industry niches and specialization, tying these to MGAs or affinity partnerships to become go-to distributors for specific industries. Lastly, as the E&S market continues to grow, brokerages have a significant opportunity to expand their scope to include wholesale business, capturing multiple revenue streams, especially in challenging exposure areas and coverage lines.

- Invest in foundational capabilities and new talent:

As brokerages drive greater levels of integration, the focus is shifting toward agencies with strong operators rather than those solely led by savvy (sales) entrepreneurs. This change demands a different leadership profile—one that can manage operators and lead the transformations required to respond to growing market pressures while continuously delivering shareholder value (e.g., standardizing integration, enhancing technology, building and attracting new talent). Such skillsets are relatively fresh to brokerage leadership, and earmarking executives to lead these transformations can be challenging in a federated model composed of corporate and regional structures, and underlying agencies. The ability to influence and drive transformation across all layers is a distinctive skillset.

Four short-term quick wins to get started

While the longer-term response to the pressures facing the brokerage industry will require focus and coordination by the C-Suite, we recommend four initial steps brokerage leaders can take to get started:

- Identify priority areas for standardization and centralization: For more fragmented brokers, we start by standardizing level one data-entry processes (e.g., AMS standard operating procedures), begin to move toward common technologies (e.g., one agency management system), and work towards centralizing common low-risk activities to show success and build buy-in for future centralization (e.g., vendor payables, data processing, policy certifications, claims handling, etc.).

- Re-evaluate M&A agenda: Update enterprise M&A appetite to be more selective; each transaction should support a long-term growth agenda and be complimentary to the core business. Explore divesting areas of the business that are non-core to generate new sources of capital and allow the enterprise to focus on what will enable the business to be an operating company, not a holding company.

- Assess business reporting and data gaps: While management can generate financial overviews and operational reports, the fragmented nature of AMS and accounting systems often requires extensive data cleansing to fulfill these fundamental reporting requirements. Understand the technology/ systems landscape (e.g., how AMS instances connect to Accounting/ Finance source of truth) and operating models across the organization to map how data flows and identify opportunities for greater data hygiene, integrity, and availability. We see brokers first prioritizing standard ways of completing financial and operational management reporting to set the foundation for deeper insights.

- Determine priority talent gaps: Decisions to act on the levers discussed above are highly strategic and likely necessary for brokerages to withstand changes in the market, but executing these decisions requires talent not typically found in today’s brokerages. Identify core talent gaps (e.g., transformation leadership, business operators, data expertise, industry specialization) to pave the road ahead and develop a plan for acquiring this talent.

We’ve helped and are actively helping brokerages navigate this evolving landscape. Please reach out to Heather Sullivan, Gina Papas, Robert Held, or Bob Besio if you’d like to discuss further.

What does market-leading cyber claims management look like? | Insurance Blog

Recently, many leading insurers have applied transformative solutions to enhance their cyber products. With the cyber insurance market projected to double to $29B by 2027, we explore what constitutes market-leading cyber claims management.

In this blog we’ll delve into the complexities of responding to cyber claims, the essential skills required by claims adjusters, and the measures insurers must take to achieve excellence in cyber claims management.

The complexity of cyber claims

The most comprehensive cyber coverage encompasses a broader range of perils than most other insurance products:

- First-party coverages: This includes damage to devices, network damage, physical property damage, and damage to digital assets. It also covers damage to or theft of intangible assets, theft of funds, and costs associated with recovery, restoration, and remediation. Financial losses due to business interruption, lost business opportunities, reputational damage, ransomware, and extortion are also included. Additionally, expenses related to investigations, notifying affected third parties, and damage to intellectual property such as patents and trademarks are covered.

- Third-party coverages: These coverages include contractual and legal liability, regulatory proceedings, and multimedia liability. They also encompass civil damages, compensation, payment card loss, errors and omissions, technology professional liability, miscellaneous professional liability, and network security and privacy liability.

When the policyholder of a comprehensive cyber product is a large multinational corporate business with both B2B and B2C customers, handling a potential large-scale claim becomes highly complex for claims adjusters. Cyber claims, akin to oil spillages, are catastrophic by nature, recognize no geographical boundaries, and are continuously evolving and unpredictable. Cyber breaches can critically impact businesses, societies, and essential national infrastructure, including hospitals, water and sewage systems, and airports.

The complexity, however, extends further. Cyber claims pose unique challenges to today’s claims adjusters due to the intricate technical nature of the claims, which involve IT systems, both tangible and intangible assets, cybersecurity protocols, digital forensics, and the constantly changing regulatory and legislative landscape concerning data protection, AI protection, and privacy law across all affected jurisdictions.

Furthermore, a cyber claims adjuster must be adept at instructing and managing a diverse group of specialists, ranging from IT forensic experts, data experts, and forensic accountants to credit monitoring experts, legal breach counsel, public relations experts, crisis management professionals, and ransomware attack experts.

The skills of a cyber claims adjuster

The skills of a cyber claims adjuster are multifaceted and require a detailed understanding of various aspects:

Knowledge Requirements: A cyber claims adjuster must possess advanced, industry-recognized qualifications and typically have a background in Errors & Omissions (E&O), Trade Credit, Political Risk, and/or Crisis Management. They need practical knowledge of applying first and third-party cyber coverages, reserving, evaluations, and risk management processes, usually gained from previous roles in cyber claims or broker advocacy.

Experience Requirements: The industry faces challenges due to a limited talent pool. It’s crucial for adjusters to understand the roles and responsibilities of various experts involved in cyber claims. Their practical experience is vital for effectively overseeing and managing these experts to ensure rapid response to claims, effective mitigation actions to prevent further losses, and complete resolution of claims. Cyber claims have grown in complexity and quantity, but many adjusters come from auxiliary lines of business. A key skill often missing is proficiency in IT systems, cybersecurity protocols, digital forensics, intangible assets, and a deep understanding of constantly evolving regulations and legislation across IT, AI, GDPR, and consumer privacy. This is particularly critical when insurance covers technology-based companies, where coverage is often bespoke and niche.

Operational Responsibilities: Adjusters must effectively determine the existence, cause, and scope of a breach and manage key activities in cyber claims management. This includes selecting and managing the appropriate incident response team, assessing ongoing or concluded breaches, evaluating the impact on the customer’s business and assessing breaches of cybersecurity protocols. It also covers responding in compliance with current data protection and privacy regulations, identifying and responding to fraud triggers, and providing feedback into underwriting risk controls and actuarial tables.

Customer Segment Knowledge: Proficient knowledge and experience with a range of customer segments, from SMEs to multinational and large corporate clients, are also essential for a cyber claims adjuster. Because Cyber is such a swiftly evolving product and still sub-scale to many other lines, insurers face the difficult question of whether to organize their Cyber claims team as a line of business CoE or whether to adhere to existing CoEs centred around SME, mid-market, multi-national clients etc.

Emerging risks and challenges

The task of determining the existence, cause, and scope of a breach is becoming increasingly complex due to the extensive coverage of cyber insurance, rapid technological and data platform evolution, the catastrophic and systemic risks associated with breaches, and the implications of Gen AI. Gen AI presents new opportunities and challenges, enhancing capabilities for both cyber attackers and defenders, leading to more sophisticated attacks almost daily.

The strategic choices to become market-leading in cyber claims

In conclusion, there are four key components to get right:

- Insurers need a claims application that supports the adjusters in effective management of the incident response team and experts. The application needs to be fit-for-purpose for cyber, which means a comprehensive master data management to orchestrate the 100+ relevant cyber claims data points as well as an expert-specific permission access to documents.

- Insurers need a comprehensive and continuous development program to remain proficient in evolving cyber risk, technology changes and especially the opportunities and challenges that Gen AI represent.

- Insurers need a comprehensive cyber saferoom that provides a secure space for pre-incident advice and training, incident response planning, notification services, etc. The saferoom must have the right guardrails that support collaboration with the independent legal breach counsel.

- Insurers need a continuous feedback-loop of claims master data that inform the actuarial tables and the risk controls in underwriting. Market-leading insurers achieve this with a scalable infrastructure and architecture, so that the technical pricing across all variables is informed in real-time based on loss history.

College Student Car Insurance Explained

A new school year is upon us. And it’s time for parents and students to discuss affordable car insurance for college students.

Whether you need to know about the cost of car insurance for college students, the discounts available for some, or the best types of car insurance for college students, the experienced team at Einsurance.com is here to help.

Education is expensive. And auto insurance topics can be confusing, we know. That’s why we provide these resources for consumers.

Keep reading for unbiased, honest information from real insurance agents on:

Right away, let’s answer your most important question.

Can I Keep My College Student on My Car Insurance Policy?

Sometimes, yes. If your child keeps your address as their primary residence, and drives a car insured as yours, they can stay on your policy.

Ultimately, if your college student is living at home and heading to the local community college, you don’t need to change much with your car insurance.

We still suggest that you:

- Review your policy to make sure you have the coverages you need (like theft or full coverage)

- Have a frank discussion with your child about safe driving and safe behavior on campus

But if your student is heading out of town — especially out of state, or to a major city — your insurer will likely require them to get a separate policy.

Don’t Mislead Your Insurer About Student Addresses

As insurance agents, we get several calls every year from parents who don’t know this, or who try to dodge the system. They often ask, “How does the insurance company know where my student lives or drives?”

When your child arrives at college, they’ll fill out paperwork for parking privileges. Insurers, the DMV, law enforcement and other organizations have access to those records.

Insurers also use more advanced technology. In 2024, they’re using satellite data, vehicle maintenance records, on-street photography and toll booth records to verify our driving habits.

New vehicles may also have the ability to record and send this information to legally qualified parties, like the DMV or insurance databases.

Ultimately, if your vehicle is parked at a college campus 1,000 miles away every day, your insurer will find out sooner or later. And if the vehicle is fully owned by, or leased by, the student, they may need their own policy.

College Student Car Insurance Basics

First, know the average college student in the US pays $2,500 to $5,000 for a full coverage policy. That equals about $210 to $425 per month that needs to be set aside in their budget.

Some college students will pay much more for a full coverage policy.

You can expect very high insurance costs if they:

- Have a poor driving history which includes DUIs or other serious charges

- Drive a very expensive vehicle

- Only recently got their license

- Have poor credit (in certain states)

- Have a history of claims or accidents

- Drive an electric vehicle (EV)

- Are male (yes, insurers do charge more to insure young males)

How Can I Save Money on College Student Car Insurance?

Right away, we see one way to save money on car insurance. Consider sending your student to school with an older, inexpensive car, and buying only liability coverage. This will likely cut your college student’s car insurance costs in half.

Consider a Cheaper Vehicle & Policy for Your College Student

It might feel expensive and risky to spend several thousand dollars cash for an older car that won’t be fully insured. However, if your college student is spending $5,000 per year on insurance alone, that’s $20,000 spent while getting a bachelor’s degree.

If your student plans on achieving a doctorate, they could spend $40,000 on auto insurance in eight years! An $8,000 used car will pay for itself several times in insurance savings. And it might be less likely to be stolen, when compared to a newer, expensive, popular vehicle.

If this purchase feels “pie-in-the-sky” right now, perhaps it’s best to send your college student to school without a car at all.

Don’t Forget About E-bikes, Scooters and Other Transportation Options

At Einsurance.com, we aim to match consumers with the right insurance for their needs, including college students and teens. But in the spirit of unbiased, full-disclosure, we must remind you that many students arrive at school without a vehicle, and that’s fine, too.

Part of their education is to learn how to live away from home; and understanding public transportation systems can be a valuable lesson. Our point is this, you don’t need to stress out about car insurance for college students.

Now, you may be thinking, “That’s great. But my child is studying abroad this year. What can you tell me about car insurance for international students?” Let’s find out.

Car Insurance for International Students

If your student is coming to the US for school, they will likely pay slightly more for auto insurance than students born here. According to our research, Geico, State Farm and Erie may offer the best rates for international students.

Also, your international student will need to apply for a new driver license. This is important, they won’t be able to buy car insurance without it.

If your child is heading overseas to study, they probably won’t bring a vehicle from home. The shipping expenses and risks make it difficult. Furthermore, your insurance policy will have little to no value outside the US.

Shopping for Car Insurance for College Students in Other Countries

Once your student arrives at school, they may wish to lease a vehicle or buy one, and they should shop around extensively for insurance.

Pro tip: Language barriers are inconvenient, and insurance is complicated in any language. Encourage your child to speak with translators or school advocates to help them get the best rates on car insurance overseas.

Studying overseas is an adventure and will bring many cultural lessons. One of them may be that autos are not needed for all lifestyles. In much of Europe and parts of Asia, many people choose to avoid vehicle ownership, because of the high costs and overall hassle. Your international college student may not even need to buy car insurance if they choose to live like a local.

Returning our gaze back home, let’s explore more about car insurance for college students living away from home.

Car Insurance for College Students Away from Home

We’ve already explained that your child may need to find their own car insurance policy if living away from home. You’re probably wondering, “Why?”

Know that insurance companies pay very close attention to claims made, thefts and college student behavior. Many parents are surprised when college student car insurance prices skyrocket because a student chooses to live and study in a city like New York or Los Angeles. Location everything, but there are still ways you can control your auto insurance costs.

In addition to buying an inexpensive car, or foregoing the vehicle entirely, your college student can:

- Pay a higher deductible (just remember, if there is a lienholder involved, they may require you to keep a certain deductible)

- Remove “bells and whistles” on a policy, like rental car coverage

- Pay off the vehicle entirely and buy a liability-only policy (though this comes with significant risk)

- Take a defensive driving course

- And look into discounts for college students

This leads nicely into our next section. Let’s explore some potential discounts on car insurance for college students.

Car Insurance Discounts for College Students

Car insurance companies know that college is a fun time for many students, and some may struggle to balance the social adventures with their responsibilities as students.

Put another way, it’s difficult to maintain excellent grades while partying hard or acting irresponsibly. And insurers always want their customers to behave responsibly.

That’s why many insurers offer good student discounts.

When shopping for car insurance for your college student, be sure to ask about these discounts, they can be significant! Usually, there is some reporting involved. Your student will need to send their grades to the insurer several times a year, and they must maintain a baseline GPA of 3.0 or higher.

Still, the savings are definitely worth the hassle. Trust us!

Next, let’s discuss how to shop for car insurance for college students.

How to Shop for College Student Car Insurance

If you’re a parent who already has car insurance, start by calling your current provider. They may offer you special discounts for your college student to gain their new business, and you might save more by bundling several policies together.

For example, some insurers offer dorm room insurance, renters insurance for off-campus housing and the like. They may offer some savings for buying these products together.

But don’t buy the first policy they quote! Be sure to shop around. Sometimes it makes good financial sense to use multiple insurance providers.

There are car insurance providers specifically marketing towards college students. These insurers will likely offer very attractive rates, because they hope to keep these customers for decades, as they become successful individuals with homes, families and more vehicles — all things that will need more insurance over the years.

Be sure to try our handy online quoting tool. Just enter your information and we’ll have auto insurers competing for your business right away.

Things You’ll Need to Get Car Insurance Quotes for College Students

Whether you’re shopping for car insurance for an international student, a student staying home, or one moving to the next big city, you’ll need certain documents/information on hand.

These include:

- The student’s full legal name

- Their new address (dorm building and room number, and school address)

- A copy of their driver’s license

- Title of the vehicle (if owned outright, or applied in some states)

- The vehicle identification number (VIN)

- A recent report card if applying for a good student discount

- Copies of defensive driving course certification if you have them

- Lienholder information (that’s the bank to which you make a car payment)

- Any other policies that might be relevant for bundling (dorm insurance, life insurance etc.)

If you already have car insurance for a college student, but you’re hoping to save money by shopping around, it helps to have the current policy on hand. This way, you can be sure you’re comparing “apples to apples” when it comes to:

- Deductibles

- Limits of liability

- Endorsements/riders

This leads to our next point, on how often one should shop for car insurance.

“How Often Should I Shop Around for Car Insurance?”

Whether you’re looking for auto insurance for yourself or for a loved one, you should shop around every few years. This could save you a ton of money over your lifetime, and it’s a valuable habit to teach your college student.

Know that insurers all tend to slowly increase your rates over time. This is true even if you’ve never made a claim, been involved in an accident, or gotten a traffic ticket. Insurers are in the business of making money, and even very safe drivers will experience rate increases.

Meanwhile, other insurance companies may be looking for customers just like you! And some insurers specialize in difficult risks, like drivers with a poor history or several DUIs. There is an insurer out there looking for your business, and we can help you find them.

We can also help you better understand the insurance products you buy every month. From life insurance to renters insurance, we cover it all.

Beyond premiums: What really drives customer loyalty? | Insurance Blog

Personal lines insurance is very price-sensitive. As discussed previously, maintaining a 20+% expense ratio is not feasible for insurers. Beyond pricing, what truly fosters customer loyalty, and how can insurers compete to increase their market share?

In this blog, I explore strategies for enhancing customer loyalty and retention, provide forecasts on the evolving risk landscape for auto and home insurance, and discuss Accenture’s predictions for how personal lines insurance buying behaviors might shift over the next decade.

The changing landscape of personal lines risk

Personal lines insurance has evolved from a specialty product to a digital commodity. Initially traded manually, it has now become a globally traded digital product. With around 4 billion vehicles and homes worldwide, personal lines insurance is both a global commodity and a constantly evolving risk.

The risk landscape varies significantly between auto and home insurance. Auto insurance covers a homogenous risk profile with approximately 600 common vehicle models globally. The rise of electric and autonomous vehicles is reshaping road regulations and vehicle repair processes and introduces new risks requiring product liability and cyber coverages.

Conversely, home insurance covers a heterogeneous risk profile with countless types of homes and building standards. The underlying home risk is significantly impacted by extreme weather that affects both frequency and severity of the damages. It’s fair to predict that extreme weather will not only impact ratings, but also building codes which would provide additional variables to price on.

While home and auto insurance represent key areas for personal lines insurance, consumers are also coping with the impacts of large-scale disruption – a volatile economic environment, residual impacts of the COVID-19 pandemic and the ongoing technology revolution have all shifted global dynamics significantly. Today, a consumer’s felt need for insurance is high, and the areas of risk that have them most concerned are shifting. We found that the rising cost of living and climate change were two top areas where consumers felt concerned about the risks but also least protected.

Generational shifts in insurance buying

The core consumers of insurance are changing. Millennials, the first generation of digital natives, are entering their peak insurance buying years. Insurers must cater to this demographic’s unique needs. Across all demographics, there is a demand for more, better, and faster services. Consumers want their unique needs met quickly and easily and are willing to share their data in exchange for a tangible better experience and product.

Strategic areas for enhancing value proposition